Must Know Trading and Investment Rules for Future Millionaires in India

Trading and investment rules are the foundation stones for building wealth in the Indian stock market. Whether you are a beginner or experienced investor, understanding these proven principles can help you double your money faster and avoid costly mistakes.

These guidelines have helped thousands of Indians achieve financial freedom through disciplined investing and smart trading decisions. The Indian market offers tremendous opportunities but you need the right framework to navigate it successfully.

Today we will explore the most important rules that can transform your financial future and put you on the path to becoming a millionaire. From quick calculation tricks to risk management strategies, these rules cover everything you need to know.

Key Takeaways On Must Know Trading and Investment

- Rule of 72 helps you calculate how quickly your money will double at any given return rate

- The 4 percent rule guides safe retirement withdrawals to make your corpus last 30 years

- Asset allocation rules like 100 minus age and 120 minus age tell you how much to invest in stocks

- PEG ratio under 1 identifies undervalued growth stocks for potential ten bagger returns

- Risk management rules protect your capital through position sizing and stop loss strategies

- Indian markets historically deliver 10 to 12 percent annual returns making these rules highly relevant

Also Read: Must Know Books to Be Millionaire: Your Ultimate Reading List for Wealth

Complete List of Trading and Investment Rules Every Indian Should Know

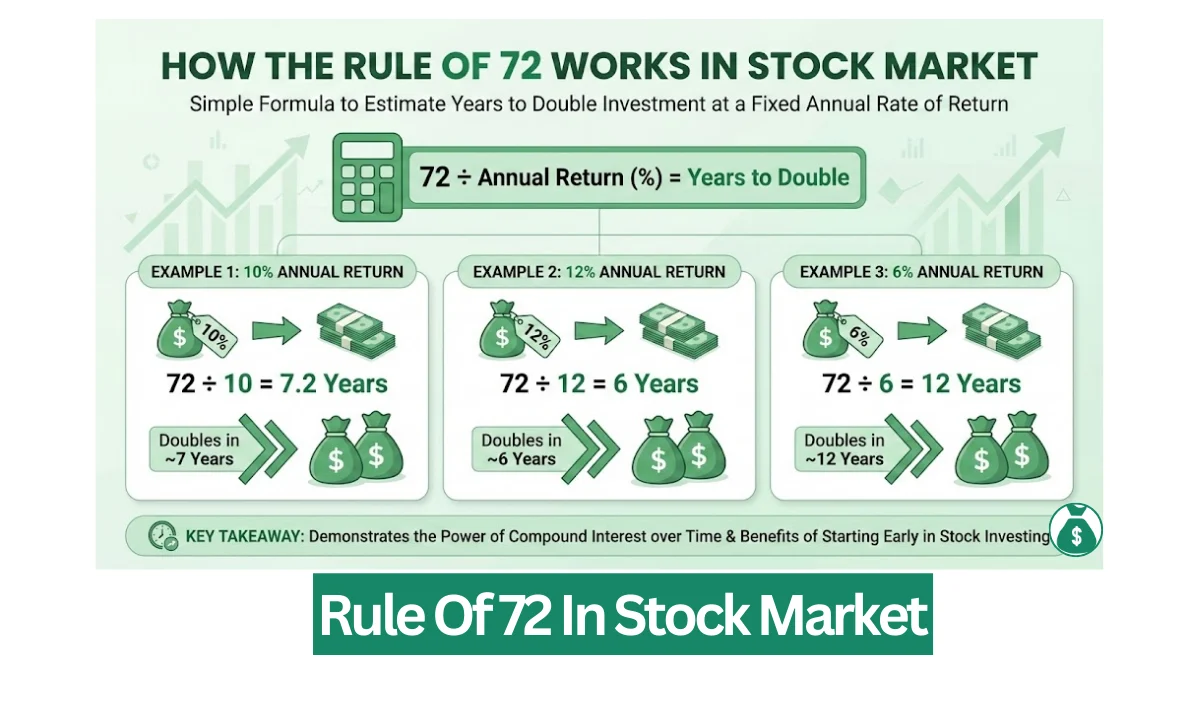

1. Rule of 72

This rule helps you estimate how long your money takes to double with compound interest. It is the most popular calculation trick used by investors worldwide.

Formula: Years to double = 72 divided by annual return percentage

Benefits: If you invest in mutual funds giving 12 percent returns your money doubles in 6 years. With 8 percent returns it takes 9 years. You can do this mental math anywhere without calculator. Also works for inflation to know when purchasing power halves.

Read In Detail About Rule Of 72

2. The 4 Percent Rule

This retirement rule tells you how much you can safely withdraw each year without running out of money. Designed to make your corpus last 30 years minimum.

Formula: First year withdrawal = 4 percent of total portfolio, then adjust for inflation annually

Benefits: With 1 crore retirement fund you withdraw 4 lakh in year one. Gives peace of mind that money will last throughout retirement. Based on historical stock and bond returns in balanced portfolio.

Read In Detail About The 4 Percent Rule In Stock Market

3. 100 Minus Age Rule

Simple formula to decide what percentage of your portfolio should be in stocks versus safe assets like bonds and fixed deposits.

Formula: Equity percentage = 100 minus your age

Benefits: A 30 year old invests 70 percent in stocks and 30 percent in bonds. As you age the formula automatically reduces risk. Younger investors get more growth potential while older investors get more safety.

Read More About 100 Minus Age Rule

4. 120 Minus Age Rule

This is the aggressive version of asset allocation that accounts for longer life expectancy and lower bond yields today.

Formula: Equity percentage = 120 minus your age

Benefits: A 30 year old gets 90 percent equity exposure for maximum growth. Even 60 year olds maintain 60 percent stocks. Suitable for Indians who have longer retirement periods and need inflation beating returns.

Read More About 120 Minus Age Rule

5. PEG Ratio Less Than 1 Rule

The price to earnings growth ratio helps you find undervalued growth stocks. Peter Lynch made this famous during his legendary Magellan fund management.

Formula: PEG ratio = PE ratio divided by expected earnings growth rate percentage

Benefits: PEG below 1 means stock is cheap relative to growth potential. Company with PE of 20 growing at 25 percent has PEG of 0.8 which is attractive. Helps avoid overpaying for growth stocks.

Read More About PEG Ratio Less Than 1 Rule

6. Ten Bagger Rule

Peter Lynch coined this term for stocks that return 10 times your initial investment. Focus on finding companies with potential to multiply tenfold.

Formula: No specific formula but look for undervalued companies with strong growth runway

Benefits: Turning 1 lakh into 10 lakh from single stock. Lynch found ten baggers in everyday companies people understood. Encourages patient long term investing in high conviction ideas.

RRead More About Ten Bagger Rule

7. The Magic Formula by Joel Greenblatt

Systematic value investing strategy that ranks stocks based on quality and cheapness. Simple enough for beginners but powerful results.

Formula: Rank stocks by high return on capital and high earnings yield, buy top ranked stocks

Benefits: Removes emotion from stock selection. Backtests show strong outperformance over market. Rebalance portfolio annually by selling losers and buying new top ranked stocks.

Read More About The Magic Formula By Joel Greenblatt

8. The 80/20 Rule or Pareto Principle

In investing 80 percent of your returns typically come from just 20 percent of your holdings. Focus on winners not over diversification.

Formula: Identify which 20 percent stocks drive 80 percent of portfolio gains

Benefits: Helps you concentrate on best performers. Trim underperformers and let winners run. Avoid owning too many stocks that dilute returns. Quality over quantity approach.

Read More About The 80/20 Rule or Pareto Principle

9. 10-5-3 Rule in Planning

Sets realistic expectations for long term annual returns from different asset classes in India. Useful for financial planning and goal setting.

Formula: Equities give 10 percent, bonds give 5 percent, savings give 3 percent annually

Benefits: Helps decide asset allocation based on return requirements. If you need 10 percent growth you must invest in stocks. Lower return expectations lead to safer bonds and deposits.

10. Rule of 20

Market valuation rule to determine if overall stock market is cheap, fair or expensive. Works for indices like Nifty and Sensex.

Formula: Fair value when PE ratio plus inflation rate equals 20

Benefits: Nifty PE of 15 plus inflation 3 percent equals 18 suggesting undervaluation. Above 20 indicates overvaluation. Helps time your market entry and exit for large investments.

11. 1 Percent Risk Rule

The golden rule of trading that protects your capital. Never risk more than 1 percent of total account on any single trade.

Formula: Maximum risk per trade = 1 percent of total trading capital

Benefits: With 1 lakh account you risk maximum 1000 rupees per trade. Even 10 losing trades in row only costs 10 percent capital. Prevents one bad decision from wiping out portfolio.

12. The 6 Percent Risk Rule

Monthly risk management rule for active traders. Limits total exposure across all open positions combined.

Formula: Total risk of all open trades plus losses should not exceed 6 percent per month

Benefits: If monthly losses and current open risk hit 6 percent you stop new trades. Forces discipline and prevents revenge trading. Protects against losing months getting out of control.

Read More About 6 Percent Risk Rule

13. 7 to 8 Percent Stop Loss

Cut your losses quickly before they become big problems. William O Neil who created CAN SLIM system swears by this.

Formula: Sell stock if it drops 7 to 8 percent from purchase price

Benefits: Small losses are acceptable but big losses destroy portfolios. Exiting at 8 percent loss protects 92 percent capital for next opportunity. Removes hope and emotion from losing trades.

14. 20 to 25 Percent Profit Rule

Book profits when stocks rise substantially. Many traders give back gains by being too greedy.

Formula: Sell position when stock rises 20 to 25 percent from buy price

Benefits: Locks in 20 percent plus gains consistently. Can always re enter if stock keeps rising. Prevents turning winners into losers during pullbacks. Compound these gains across multiple stocks.

15. 3 to 1 Risk Reward Ratio

Every trade should target profit that is three times bigger than potential loss. Ensures profitability even with average win rate.

Formula: Target profit = 3 times stop loss distance

Benefits: Risk 100 rupees to make 300 rupees per trade. Even 40 percent win rate keeps you profitable. Forces you to skip low probability setups. Professional traders use 2 to 1 minimum.

16. 3 Day Rule

Wait three days after major price drop or bad news before buying stock. Avoids catching falling knife.

Formula: Wait 3 trading days after significant selloff before entering position

Benefits: Lets panic selling exhaust itself. Often stocks drop further after bad news as weak hands exit. Waiting finds better entry price. Removes FOMO driven mistakes.

17. 5 Percent Position Limit

Diversification rule that prevents concentration risk. No single stock should dominate your portfolio initially.

Formula: Maximum 5 percent of portfolio value in one stock at purchase

Benefits: With 10 lakh portfolio you invest maximum 50000 rupees per stock. One stock going zero only costs 5 percent. Winners can grow beyond 5 percent naturally. Balances diversification with concentration.

Implementing These Rules for Wealth Creation

Now you know all the important trading and investment rules that work in Indian markets. Start by using rule of 72 to set realistic return expectations. Apply 100 or 120 minus age formula to determine your equity allocation. Use PEG ratio and magic formula to find quality stocks at reasonable prices.

Implement strict risk management with 1 percent rule and proper stop losses. The 4 percent rule helps plan retirement withdrawals. These are not complicated theories but practical tools used by successful investors.

Remember every crorepati in stock market followed some version of these principles. Adapt them to your personal situation and risk appetite. Track your performance and refine your approach over time. The combination of growth rules and risk management creates complete framework for success.

Indian markets reward disciplined investors who follow proven rules consistently. Start your millionaire journey today by implementing just two or three rules first.

Tags: trading rules India, investment rules, rule of 72, asset allocation, PEG ratio, risk management, stock market India

Share This Post