The 4 Percent Rule In Stock Market: Benefits, Limitations & Public Opinion

The 4 Percent Rule In Stock Market: Benefits, Limitations & Public Opinion

The 4 percent rule is one of the most well known retirement spending guidelines in the investment world. It suggests that a retiree can withdraw 4 percent of their portfolio in the first year and then adjust the amount every year for inflation. The goal is simple. Your savings should last for about 30 years without running out.

This rule was first introduced by financial adviser Bill Bengen in 1994. It was built on historical data of balanced stock and bond portfolios.

Today, many investors still use it as a starting point. But current market conditions, longer life spans, and changing strategies have started new debates around how useful or flexible the rule is.

Key Takeaways On 4 Percent Rule In Stock Market

- The 4 percent rule guides retirement withdrawals over a 30 year period.

- It was designed for a balanced portfolio of stocks and bonds.

- Experts now debate if 4 percent is too high, too low, or still reasonable.

- Market returns, inflation, taxes, and fees can affect outcomes.

- Many investors now prefer a flexible spending approach.

What The 4 Percent Rule Means

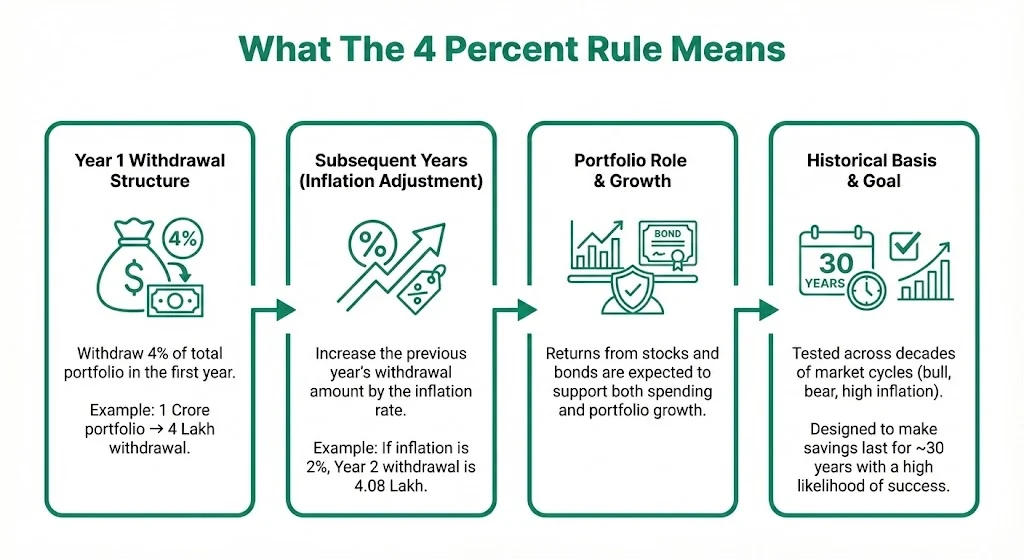

The 4 percent rule suggests this simple structure. In the first year of retirement, you withdraw 4 percent of your total portfolio. In the next years, you increase that same withdrawal amount based on inflation. The idea is that returns from stocks and bonds will support both spending and growth so your savings last for about 30 years.

For example, if you have 1 crore saved, you would withdraw 4 lakh in the first year. If inflation rises by 2 percent, the next year you withdraw 4.08 lakh. This pattern continues year after year.

This rule was originally tested across several decades of market history. It covered strong bull markets as well as weak periods with crashes and high inflation. The conclusion was that 4 percent had a high likelihood of success for a traditional 30 year retirement.

Also Read: Rule of 72 In Stock Market: A Simple Way To Estimate Wealth Growth

The Origins Of The Rule

Bill Bengen studied US stock and bond data from 1926 to 1976. He wanted to find a safe withdrawal rate even in the worst sequence of returns. His research showed that portfolios withdrawing 4 percent per year did not fail before at least 30 years, and often lasted longer.

Over time, the rule became a common financial planning benchmark. It gained popularity because it was simple, easy to explain, and backed by historical performance patterns.

Why The 4 Percent Rule Is Under Debate Today

Markets change over time. Interest rates move up and down. Life expectancy increases. Investors retire earlier. These shifts lead experts to question if 4 percent is still the right number for modern portfolios.

Recent expert views show this change in thinking.

Expert Trends And Updated Views

Here is a summary of recent expert opinions and research findings:

- Morningstar recommended a safer 3.9 percent starting withdrawal rate for 2026 retirees, aiming for 90 percent success over 30 years.

- Bill Bengen updated his research and suggested that 4.7 percent or higher may be safe for diversified portfolios.

- Charles Schwab and Vanguard highlight flexible withdrawal strategies instead of fixed rules.

These opinions reflect a growing belief that investors should adjust withdrawals based on markets, inflation, and personal goals rather than follow one fixed formula forever.

What The Public Thinks Today

Recent investor discussions on X (formerly Twitter) show mixed opinions. Many users still see the 4 percent rule as a helpful benchmark. It is simple and familiar. But critics say modern markets make the rule outdated or risky.

Some users believe 4 percent is too aggressive when markets fall early in retirement. Others think it is too conservative and restricts lifestyle spending. Supporters say it is a useful starting point as long as investors remain flexible.

Many early retirees and FIRE followers raise concerns that 30 years may not be enough. They may need income for 40 or even 50 years. This increases the risk of running out of money if returns underperform.

A Look At Current Data And Opinions

Here is one simple list summarizing the latest trends and expert statements around the 4 percent rule:

- Morningstar suggests 3.9 percent as a safer starting rate for 2026 retirees.

- Some portfolios may support up to 5.7 percent for aggressive investors.

- Bill Bengen says 4.7 percent or more may be safe with diversification.

- Many advisers now prefer flexible withdrawal systems with guardrails.

- Investors worry about sequence of returns risk and market downturns.

This shows that the original rule has evolved into multiple approaches based on risk tolerance and investment style.

Why The Rule Works Best With A Balanced Portfolio

The 4 percent rule assumes a mix of stocks and bonds. Stocks provide growth. Bonds provide stability. If the portfolio becomes too aggressive or too conservative, the results may differ.

Higher stock exposure may support higher long term returns, but it increases volatility. More bonds reduce risk but may lower growth. That is why most studies use balanced allocations.

Risks To Consider With The 4 Percent Rule

Even though the rule comes from strong research, it does not remove risk. Real markets do not follow averages every year. Some key risks include:

- Early retirement in a bear market

- High inflation periods

- Taxes and fees reducing returns

- Medical expenses increasing

- Longer than expected life spans

The biggest threat is sequence of returns risk. If markets fall sharply in the early retirement years, withdrawals can permanently damage portfolio recovery.

Why Flexibility Matters Today

Many financial planners now recommend flexible withdrawal strategies. These allow retirees to reduce spending in weak market years and increase it in strong years. This reduces the chance of failure.

Examples include:

- Guardrail strategies

- Variable percentage withdrawals

- Spending bands

- Dividend and cash flow approaches

The goal is to adapt rather than follow a fixed number every year.

Does The 4 Percent Rule Still Work?

The answer depends on the investor. For traditional retirees with balanced portfolios and steady expenses, the rule still offers a helpful baseline. It can guide savings targets and income planning.

But for early retirees, high inflation environments, or very conservative investors, the ideal rate may be closer to 3 to 4.5 percent depending on conditions.

Experts agree on one key point. Personalization is important. There is no single number that fits everyone.

What Investors Should Keep In Mind

Investors using the 4 percent rule should consider:

- Portfolio allocation

- Retirement duration

- Lifestyle goals

- Taxes and fees

- Risk comfort

- Market environment

Regular reviews help ensure that withdrawals remain realistic and sustainable.

The Bottom Line

The 4 percent rule has shaped retirement planning for more than 30 years. It remains a respected and familiar guideline based on real historical data. But modern conditions, market uncertainty, and longer retirements mean that many investors now see it as a starting point instead of a strict rule.

The key idea remains unchanged. Spend in a disciplined way. Protect your capital. Allow your portfolio to grow. Use flexibility to manage risk. A balanced strategy can help you turn savings into steady income across your retirement years.

Tags: retirement planning, 4 percent rule, safe withdrawal rate, investing basics, stock market investing, personal finance

Share This Post