Why Reliance Share Is Falling: Key Reasons & Public Sentiment

Why Reliance Share Is Falling: Key Reasons & Public Sentiment

Reliance Share is one of the most tracked stocks in India. So when the share price falls sharply, the whole market starts asking one question. Why is Reliance share falling.

The stock recently saw a steep decline of about 4 to 5 percent. It slipped from near ₹1,578 to almost ₹1,497 to ₹1,508 in intraday trade. This fall also erased more than ₹1 lakh crore in market value. It became one of the biggest drags on the Nifty 50 and Sensex.

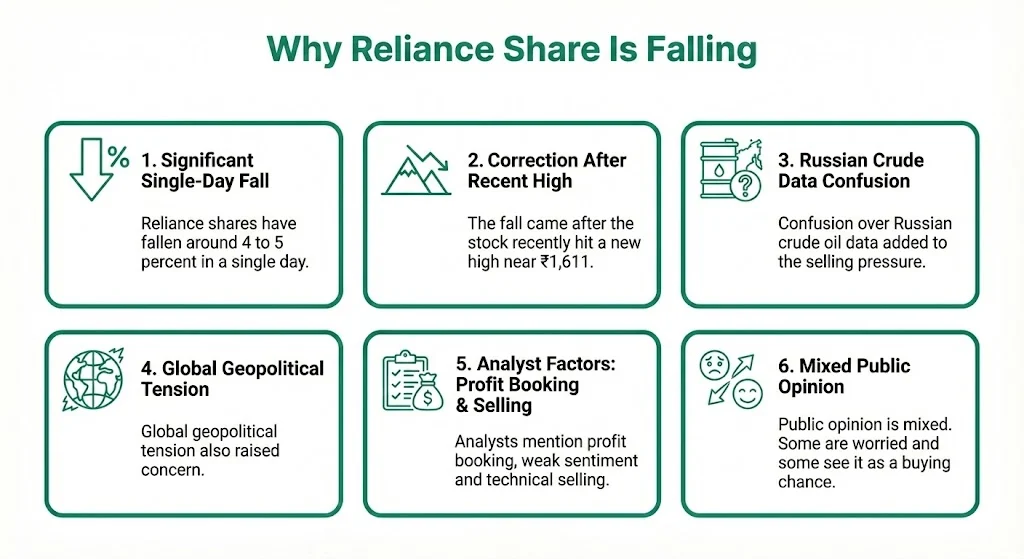

Key Takeaways On Why Why Reliance Share Is Falling?

- Reliance shares have fallen around 4 to 5 percent in a single day.

- The fall came after the stock recently hit a new high near ₹1,611.

- Confusion over Russian crude oil data added to the selling pressure.

- Global geopolitical tension also raised concern.

- Analysts mention profit booking, weak sentiment and technical selling.

- Public opinion is mixed. Some are worried and some see it as a buying chance.

Reliance shares had touched a fresh high around ₹1,611. After such a sharp rally, many short term investors chose to book profits. At the same time, news flow about Russian crude oil and global oil market tension created more caution. The fall also took place during a weak market phase with high trading volumes.

Also Read: Why Trent Share Is Falling: Main Reasons & Public Reaction Jan 2026

Reliance Share: Profit Booking After A Strong Rally

Reliance had already shown a strong move in recent months. It even reached its 52 week or near all time high. At such levels, traders often choose to lock gains. This is a common market behaviour. When a heavyweight stock corrects, the impact looks bigger because of its index weight.

This profit booking does not mean that the company’s long term outlook is negative. But in the short term, the selling pressure can be sharp. This is more visible when market volatility is already high. Higher volumes also suggest that many traders were closing their short term positions.

Reliance Share: Confusion Over Russian Crude Oil Report

Another major trigger was a Bloomberg report. It said that three tankers with Russian crude oil were heading towards Reliance’s Jamnagar refinery. This created fear of geopolitical risk and possible US tariff related issues. It also raised doubt about crude sourcing and refinery margins.

Reliance came forward and strongly denied the report on X. The company clearly said that no Russian crude cargo had arrived in the past three weeks. It also said that no delivery was expected in January. Reliance termed the report completely wrong.

Even after this denial, the market stayed nervous. Traders reacted to the initial headline. Some feared that concerns related to Russian crude may return again. This uncertainty pushed many investors to reduce exposure in the short term.

Reliance Share: Global geopolitical concerns also in focus

Broader geopolitical events added more pressure. The US and Venezuela crisis increased worries about global oil supply risk. Venezuela is a key oil producing nation. Any escalation can lead to swings in global crude prices.

For a large energy company like Reliance, changes in crude prices can affect margins. If raw material costs rise faster than product prices, near term earnings can face pressure. This creates caution among traders. Even the fear of volatility is enough to trigger selling.

There were also public discussions on social media about possible tariff actions under the incoming US administration. Some users linked this to India’s oil sourcing decisions. This noise added to the sentiment pressure.

Reliance Share: Weak broader market sentiment

The fall also happened during a broader market correction. Benchmarks were already under pressure. In such periods, investors often cut positions in large liquid stocks first. Reliance has heavy index weight. So its fall also dragged the index lower and vice versa.

The stock also broke key technical support levels. This triggered more selling. Some analysts pointed out that Reliance slipped below moving average zones. Once this happens, short term traders tend to exit quickly. This magnifies the correction.

Analyst actions and sector concerns

There were also reports that some global brokerages turned cautious. One such report mentioned removal of Reliance from a model portfolio. The reasons included high capital spending and uneven performance across business segments. Retail competition was also cited as a factor. At the same time, the oil and energy sector itself was weak.

Although these are not sudden shocks, such developments add to cautious sentiment. When combined with other headlines, they can speed up profit booking.

Public Sentiment On Social Media

Recent posts on X show mixed public opinion. Some people expressed shock and pain. A few highlighted that over ₹1 lakh crore of value was wiped out. Many retail investors shared regret about their timing. Some said they entered the stock just before the fall.

At the same time, some users saw this fall as a buying chance. Long term investors mentioned their trust in the company’s business strength. There were also discussions about crude oil, Russian supply denial and possible tariff concerns. A number of users mentioned the ₹1,500 level as an important support zone.

So the mood is divided. Traders appear cautious. Long term investors remain more confident.

Key Reasons Behind The Reliance Share Fall

- Profit booking after the stock reached a recent high near ₹1,611.

- Confusion and fear after the Russian crude oil report.

- Global geopolitical risk around oil producing nations.

- Weakness in the broader market and index pressure.

- Technical breakdown below important support levels.

- Analyst caution and sector level concerns.

- Higher trading volumes showing exit by short term players.

Is this fall only short term

From current data and sentiment, most factors look short term in nature. There is no major fundamental change in core business. Reliance still has strong presence in energy, telecom and retail. These businesses continue to generate steady revenue streams.

Analysts also say that some parts of the oil market risk can even turn positive. For example, if heavy crude supply becomes cheaper for a period, complex refiners like Reliance may benefit. However, markets tend to react first to uncertainty. Stability usually returns only after clarity improves.

What investors should note

Investors must understand that large cap stocks can also face sharp declines. News flow driven movement is common in the near term. Reliance is a market heavyweight. So every small development appears bigger at the index level.

For traders, technical levels and sentiment matter. For long term investors, business fundamentals matter more. Based on current information, the decline seems driven by headlines, crude concerns and profit booking. It does not signal any confirmed structural breakdown in the company’s core operations.

Conclusion

Reliance share has fallen sharply due to a mix of profit booking, geopolitical tension, confusion over crude sourcing and weak broader market mood. Public reaction remains divided. Traders are cautious. Long term investors continue to believe in the company.

The coming weeks may see more news flow around crude markets and global policy moves. Investors will also watch the upcoming quarterly results. Any stability in oil prices and clearer communication from the company can help calm sentiment.

For now, the fall looks like a market reaction to uncertainty rather than damage to long term fundamentals.

Tags: Reliance Industries, Reliance share price, Stock Market India, Nifty 50, Oil and Energy Sector, Market News

Share This Post