Why Trent Share Is Falling: Main Reasons & Public Reaction Jan 2026

Why Trent Share Is Falling: Main Reasons & Public Reaction Jan 2026 | Image With UpStocks

Trent Ltd, the Tata Group retail company that runs Westside and Zudio, saw a sharp fall in its share price on January 6, 2026. The stock slipped around 8 to 9 percent during intraday trade and hit levels near ₹4,000 to ₹4,060. This decline erased more than ₹13,000 crore in market value in a single session.

The fall also comes at a time when Trent has already corrected heavily from its 2025 highs. The stock is now down nearly 40 to 50 percent from peak levels of about ₹7,000 to ₹8,000. The latest drop has raised questions among investors about demand trends, store productivity and valuation risk.

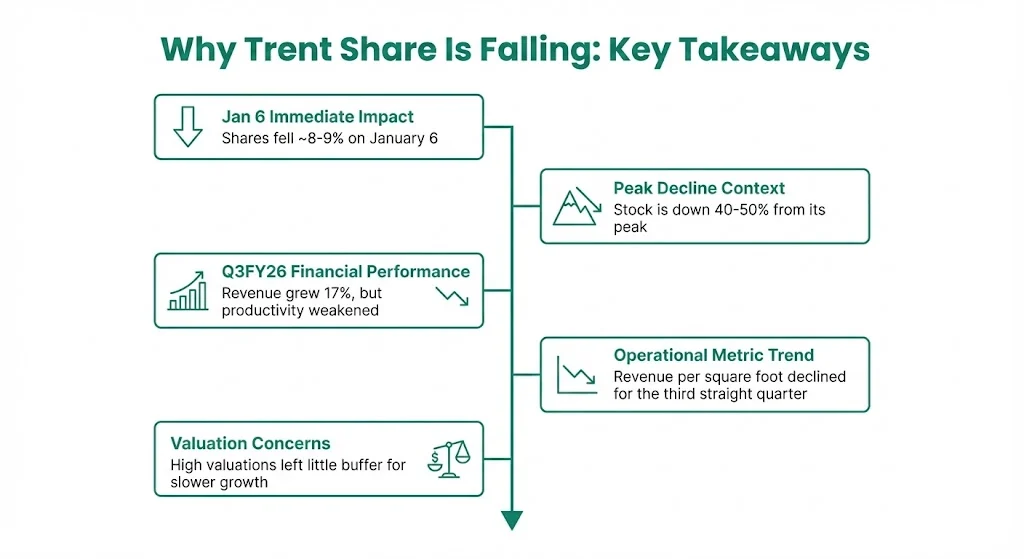

Key Takeaways On Why Trent Share Is Falling

- Trent shares fell around 8 to 9 percent on January 6

- The stock is already down 40 to 50 percent from its peak

- Q3FY26 revenue grew 17 percent but productivity weakened

- Revenue per square foot declined for the third straight quarter

- High valuations left little buffer for slower growth

Also Read: Why Reliance Share Is Falling: Key Reasons & Public Sentiment

Trent Share Price Reaction After Q3 Business Update

The sharp fall came after the company announced its Q3FY26 business update post market hours on January 5. Trent reported standalone revenue of ₹5,220 crore, up 17 percent year-on-year. Store expansion continued at a fast pace, with 17 new Westside outlets and 48 Zudio stores added during the quarter.

However, sequential revenue growth remained flat at 17 percent, the same as the previous quarter. This lack of acceleration raised concerns about demand momentum. Many investors were hoping for stronger growth after recent corrections in the stock.

Trading volumes jumped sharply as selling pressure increased. The stock also became one of the biggest losers on benchmark indices during the session.

Slowdown In Productivity And Store Level Sales

While total revenue increased, productivity trends weakened. Revenue per store dropped about 11 percent year-on-year. Revenue per square foot declined around 15 to 16 percent. This marks the third straight quarter of decline.

Analysts point out that rapid store expansion is now causing cannibalisation. New outlets are opening close to existing locations, which splits customer footfall. Same-store sales growth has slowed to low single-digit levels.

This is a big change from the past few years when growth remained strong. Earlier, revenue used to grow at 40 to 60 percent levels. For the first nine months of FY26, growth has now moderated to around 18 percent.

Muted consumer spending, weak fashion retail demand and unseasonal rainfall have also hurt sales momentum across the sector.

Why High Valuation Became A Risk

Even after the recent fall, Trent continues to trade at premium valuations. The stock is priced at around 90 to 100 times earnings. When valuations are this high, even small disappointments can trigger sharp corrections.

For the past few years, Trent was seen as a consistent compounder. Strong execution, fast scale-up of Zudio and improving profitability supported its premium valuation. But as growth begins to normalise, the market is reassessing assumptions.

Institutional funds with heavy exposure to the stock are also reducing positions as risk sentiment weakens. This adds to selling pressure in the near term.

What Brokerages Are Saying

Brokerage views on Trent now remain mixed.

Morgan Stanley has maintained an Overweight rating. It believes expansion momentum continues and long-term prospects stay intact. It has set a target price near ₹5,456.

HDFC Securities has upgraded the stock to Add after the steep correction. Its target price is around ₹4,700.

However, other analysts are cautious. Brokerages like Citi, UBS and Motilal Oswal have highlighted declining productivity and slowing consumer demand. They believe earnings downgrades may continue if current trends persist.

What People Are Saying On Social Media

Public sentiment on X shows clear concern about the stock’s decline. Many retail investors highlighted the sudden fall and weakening growth numbers. Some users expressed regret over entering the stock at premium valuations.

A common theme across reactions is that revenue growth is now driven more by new store openings rather than higher spending per store. Several posts also pointed to Trent losing over ₹13,000 crore in market cap in one session.

However, some investors still see long-term value after the correction. They continue to believe in the scale-up of Zudio and the strength of Tata Group ownership. For them, the risk-reward profile looks better than before.

Main Reasons Behind The Fall In Trent Share Price

- Slowing growth momentum compared to earlier high double-digit levels

- Declining revenue per square foot for three straight quarters

- Signs of cannibalisation from rapid store expansion

- Consumer demand weakness in the fashion retail sector

- High valuation that left little margin for disappointment

- Heavy institutional ownership increasing downside pressure during corrections

Sector Weakness Adding To Pressure

The broader retail sector is also facing challenges. Fashion consumption has slowed compared to the post-pandemic boom. Competition is rising across value fashion, online retail and large brands. Weather fluctuations have further affected seasonal demand.

With many retail stocks trading at high multiples, any revenue slowdown is being punished quickly by the market.

Long Term Outlook Still Depends On Execution

Despite the current challenges, Trent still remains one of the strongest players in Indian retail. Zudio has built leadership in the value fashion space. Westside continues to maintain a premium brand position. Store economics remain attractive compared to many peers.

The key question now is whether Trent can stabilise productivity while continuing expansion. If like-for-like sales improve and demand strengthens, confidence may return. But if growth continues to slow, pressure on the stock may persist.

For now, investors are choosing caution until there is clarity on trends in upcoming quarters.

Investor Sentiment Divided

Short-term sentiment remains weak as earnings expectations are being adjusted downward. However, long-term admirers of the business model still believe that the company can deliver structural growth over time.

This divergence is what is driving volatility in the stock.

Conclusion

The recent fall in Trent share price reflects a clear shift in market perception. Growth is no longer at hyper-levels. Store expansion continues, but productivity has softened. High valuation has amplified the correction as investors adjust expectations.

While the Tata Group backing and strong business model provide comfort for long-term investors, the near-term outlook depends on whether demand improves and store-level metrics recover. Until then, the stock may continue to react sharply to news flow and quarterly updates.

Tags: Trent share price, Tata Group stocks, Zudio growth, Indian retail sector, stock market news, Trent Q3 update

Share This Post