100 Minus Age Rule: Simple Guide To Smarter Asset Allocation

100 Minus Age Rule: Simple Guide To Smarter Asset Allocation

The 100 Minus Age Rule is a classic investing guideline that helps investors split their money between equities and safer assets.

The logic is simple. You subtract your age from 100. The result is the percentage that goes into stocks. The rest goes into bonds, fixed income, or cash. This rule helps balance growth and safety through different life stages.

Key Takeaways On 100 Minus Age Rule

- The 100 Minus Age Rule links your investment risk to your age.

- Younger investors hold more equity for growth.

- Older investors shift towards stable assets for capital protection.

- Many experts now suggest versions like 110 or 120 minus age.

- The rule is meant as guidance, not a fixed law.

- Current trends show mixed opinions about how modern it remains.

This principle has been shared for years in investing books, media, podcasts, and financial education. In 2025 and 2026, the conversation around it continues. Many still see it as a simple way to begin planning asset allocation. At the same time, many analysts feel that longer life expectancy and inflation require updates to the original version.

Table of Contents

How The 100 Minus Age Rule Works

The formula is easy to remember.

You subtract your age from 100. The number you get is the percentage of your portfolio that should be in equities. The remaining part stays in safer assets like bonds or fixed income.

For example:

- At age 30: 70 percent equities. 30 percent bonds.

- At age 50: 50 percent equities. 50 percent bonds.

- At age 70: 30 percent equities. 70 percent bonds.

This creates a glide path. Risk decreases naturally as you age. Younger investors have more time to recover from market falls. Older investors focus more on preserving wealth.

Why 100 Minus Age Rule Became Popular

This model is based on lifecycle investing. In the early years, your earning power is high and your investment horizon is long. So equities can help build wealth through compounding. Later, when retirement approaches, protecting capital becomes important.

The rule:

- keeps investing simple

- reduces emotional decisions

- creates discipline over time

It also helps beginners who feel unsure about risk and allocation. Instead of guessing, they follow a structure that adjusts with age.

Also Read: The 6 Percent Risk Rule That Traders Ignore: Protect Your Account Before It’s Too Late

Why Many Investors Still Use 100 Minus Age Rule Today?

In recent years, social media, investing educators, and financial communities continue to highlight this rule. Many tweets and discussions describe it as a golden formula for basic asset allocation. Younger investors share it as a helpful starting point for long-term planning. Global and Indian investors also refer to it when explaining mutual fund and stock allocation.

People like it because it is easy to understand. It feels logical. It also avoids extremes such as going 100 percent into stocks at any age.

The Modern Debate Around The Rule

Although the rule remains popular, modern research shows that it may now be too conservative. Life expectancy has increased. Many retirees may spend 25 to 30 years in retirement. Inflation also reduces purchasing power. Lower stock allocation may limit long-term growth during retirement.

This is why many experts now suggest updates like:

- 110 minus age

- 120 minus age

For example, under 120 minus age:

- Age 60 investor may still hold 60 percent equities.

This allows more growth to support longer retirement years.

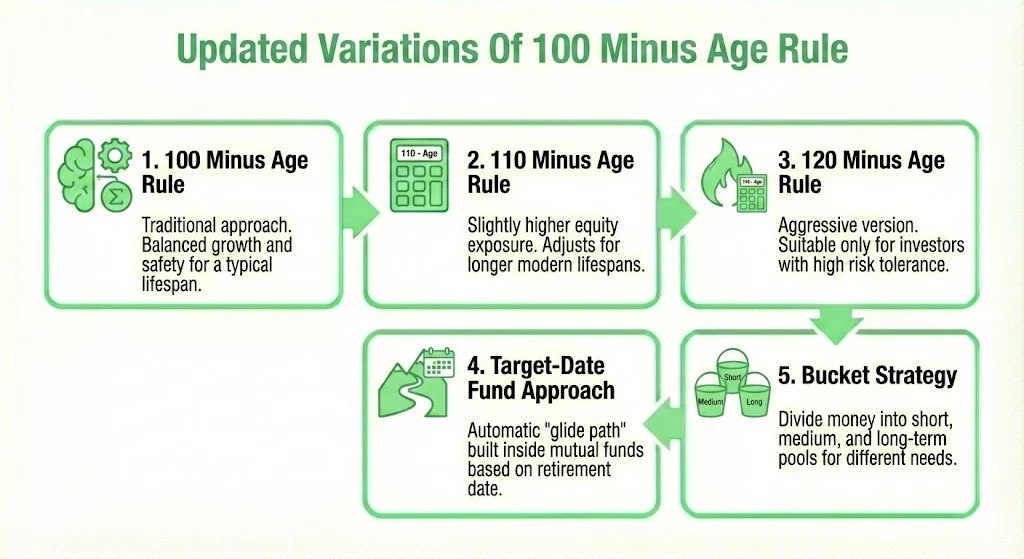

Updated Variations Of The Rule

- 100 Minus Age Rule: Traditional approach. Balanced growth and safety.

- 110 Minus Age Rule: Slightly higher equity exposure for longer lifespans.

- 120 Minus Age Rule: Aggressive version. Suitable only for high risk tolerance.

- Target-Date Fund Approach: Automatic glide path built inside mutual funds.

- Bucket Strategy: Divide money into short, medium, and long-term pools.

Current Market Context For 2025–2026

Recent opinions show rising interest in bonds due to improving yields. At the same time, technology and AI-based stocks remain popular but are sometimes viewed as overvalued. This environment has pushed many advisors to stress balance. Not too aggressive. Not too defensive.

This aligns closely with the purpose of the original rule.

Where The Rule May Fall Short

The simplicity of the rule is also its weakness. It does not account for:

- personal risk tolerance

- job security

- health

- inheritance planning

- retirement lifestyle goals

Two people of the same age may need very different allocations. A government employee with a pension may afford higher equity allocation. A freelancer with unstable income may prefer more safety.

It also ignores other asset classes such as gold, REITs, or commodities.

Why People Still Trust It

Despite its limits, the rule works as a starting point. It removes confusion. Investors do not delay decisions. They begin investing and learn gradually. The rule also encourages diversification rather than extreme risk-taking.

Many posts online highlight that it is not a strict law. Instead, it acts as guidance to be adjusted over time.

Should You Follow The Rule Today?

The answer depends on your goals and comfort with risk. The rule suits beginners who want a basic framework. It is also helpful for those planning a traditional retirement. However, investors with longer horizons or strong pensions may choose higher equity exposure.

Retirees now need protection from inflation. So a slightly higher equity share can sometimes make sense. But risk appetite remains personal.

A Simple Example Of Allocation By Age

At age 30

70 percent equities

30 percent bonds

At age 50

50 percent equities

50 percent bonds

At age 70

30 percent equities

70 percent bonds

This pattern reflects gradual movement from growth to security.

Final Outlook

The 100 Minus Age Rule has guided investors for decades. It remains relevant because of its clarity and logic. But modern realities such as longer lifespans and inflation mean the rule should be flexible. Many people now adjust it slightly upward rather than follow it strictly.

Investors should see it as a base guideline. Not a fixed formula. Real-world allocation should include risk tolerance, income stability, and personal goals.

A balanced mix of growth and safety remains the core message of the rule. That message is still important today.

Also Read: Must Know Trading and Investment Rules for Future Millionaires in India

Tags: asset allocation, investing rules, retirement planning, equities vs bonds, personal finance, long term investing

Share This Post