120 Minus Age Rule: Smarter Investing Formula for Long Term Wealth

120 Minus Age Rule: Smarter Investing Formula for Long Term Wealth

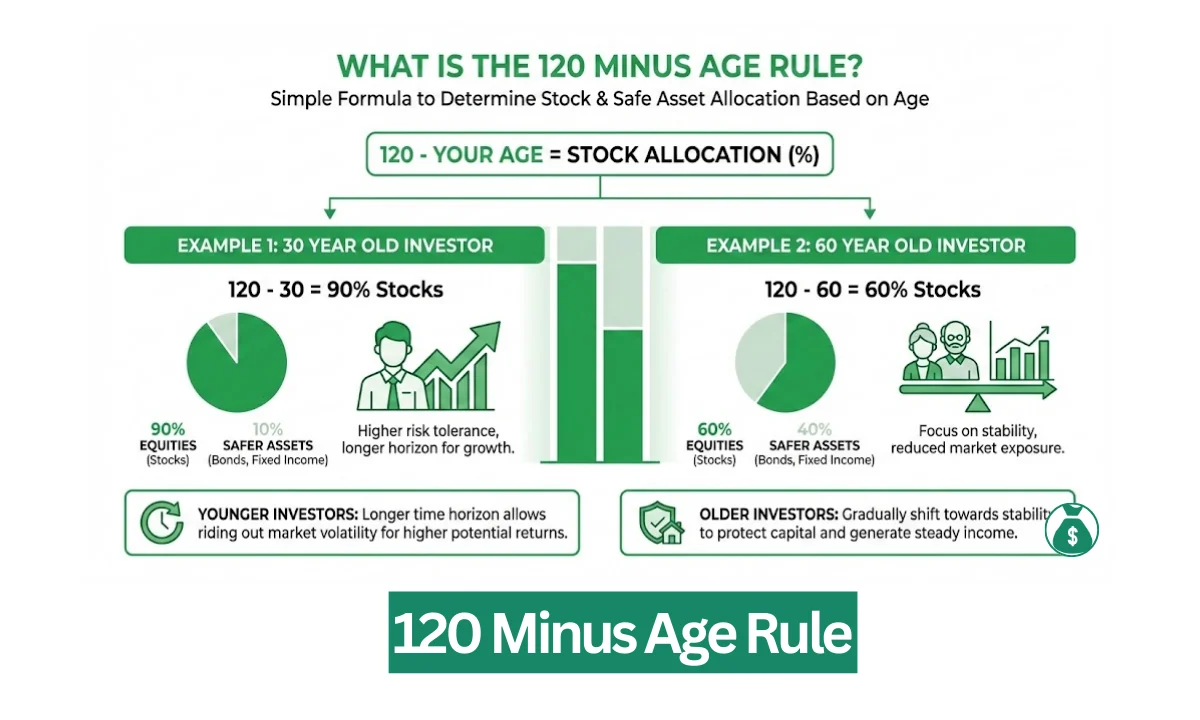

The 120 minus age rule is a popular investment guideline used to decide how much of your portfolio should stay invested in stocks and how much should move into safer assets. The rule is simple. You subtract your age from 120.

The number you get becomes your ideal stock allocation. The rest goes into conservative assets like bonds or fixed income. This approach builds on the old 100 minus age rule and adjusts for longer life expectancy and rising retirement needs.

Key Takeaways

- The 120 minus age rule helps guide asset allocation by age.

- Stocks remain a higher share of the portfolio for longer.

- It aims to balance growth, inflation, and retirement risk.

- The rule is flexible and depends on risk tolerance.

- Social media discussions show strong support for its simplicity.

The rule is talked about widely in personal finance. Retail investors, educators, and financial advisors often use it as a starting point when planning long term portfolios. It aims to keep risk at a suitable level based on age while allowing growth to continue through equity investment. This matters because retirement periods are longer today, and returns from fixed income are often lower than before.

Table of Contents

What Is the 120 Minus Age Rule

The 120 minus age rule says that your stock allocation should equal 120 minus your current age. The rest of the portfolio goes into lower risk assets such as bonds, fixed deposits, government securities, or fixed income instruments.

For example, a 30 year old investor would keep 90 percent of their portfolio in equities and 10 percent in safer assets. A 60 year old investor would keep 60 percent in stocks and 40 percent in stable returns.

The simple structure makes it easy for beginners to understand portfolio allocation. Younger investors hold more equities.

Older investors shift gradually toward stability. The idea is that a longer time horizon allows younger investors to ride out market volatility. Over many years, equities have historically delivered higher returns than conservative options.

Why the Rule Became Popular

The earlier guideline was known as the 100 minus age rule. It kept investors more conservative at younger ages. But as people live longer and retirement spans grow, investors need portfolios that last decades. A low equity allocation early in life could mean slower wealth creation.

That is why the 120 minus age rule updated the method to allow more exposure to growth assets for a longer period.

Another reason is inflation. Rising living costs reduce the real value of money. Equities have often outperformed inflation across long periods. This helps protect purchasing power.

At the same time, fixed income instruments may not always beat inflation consistently, especially during periods of lower interest rates. So the 120 minus age rule seeks a balance between growth and protection.

How the Rule Works in Real Life

Investors using this framework adjust their allocation every few years. As age increases, the proportion of the portfolio in equities drops slowly. This supports a lifecycle investing style. The early years focus on accumulation and growth. Later years focus on preservation and income stability.

Examples include:

- Age 25: 95 percent stocks, 5 percent bonds

- Age 40: 80 percent stocks, 20 percent bonds

- Age 55: 65 percent stocks, 35 percent bonds

- Age 70: 50 percent stocks, 50 percent bonds

This shift aims to reduce the impact of market downturns as retirement approaches. However, the rule is only a guideline. Investors still need to consider personal risk tolerance, income sources, savings levels, and long term goals.

What People Are Saying Online in 2025 and 2026

Recent posts on X show that the rule continues to attract attention. Many users point out that it is simple, practical, and beginner friendly. Financial coaches and advisors often explain it in the context of disciplined long term investing. Some creators compare it to target date funds which automatically rebalance allocation with age.

Others mention variations. For example:

- Aggressive investors may follow 120 minus age.

- Moderate investors may follow 100 minus age.

- Conservative investors may follow 80 minus age.

There are also comments about diversifying into ETFs, gold, or emerging markets along with equities and bonds. A few people debate whether the rule is too rigid. Still, overall sentiment remains positive because it offers a clear framework that avoids extreme risk taking or emotional decision making.

Public Opinion on the Rule

Most investors online appreciate the clarity of the rule. They like that it encourages higher stock exposure at younger ages when risk capacity is higher. They also value the shift toward safer assets later in life. It supports disciplined investing rather than timing the market.

Some users treat it as a starting point rather than a strict formula. They adjust based on income stability, personal comfort with market swings, health, retirement timing, or lifestyle needs. Many also highlight that emotional control matters. If an investor panics during market drops, a lower stock allocation may still be suitable even if the formula suggests otherwise.

How It Compares With the 100 Minus Age Rule

The 100 minus age rule was once the most common asset allocation shortcut. But it often led to portfolios that became conservative too quickly. With rising life expectancy, retirees may need income for 25 to 30 years or more. Holding too much in low risk assets increases the chance of falling behind inflation and running short of income.

The 120 minus age rule keeps growth going for longer. This helps support future retirement withdrawals. Over time, this approach has replaced the old rule for many investors and advisors.

When the Rule May Not Fit

The rule is not a guarantee. It does not replace financial planning. Investors should review:

- Risk tolerance

- Income needs

- Health outlook

- Market conditions

- Dependents

- Debt levels

- Emergency savings

Someone retiring early may choose a more conservative allocation. Someone with high job security and strong savings may choose a slightly more aggressive one. The key point is flexibility.

Benefits of the 120 Minus Age Rule

- Simple to understand for beginners

- Encourages long term growth through equity exposure

- Adjusts naturally with age and life stage

- Helps protect against inflation over time

- Reduces risk closer to retirement

- Supports disciplined asset allocation

Why It Still Matters Today

The rule remains important because it teaches investors how to think about risk and time horizon. Younger investors often have decades before retirement. This allows them to recover from market downturns. Older investors need greater protection as withdrawals begin. The rule captures this shift in a single formula.

It also supports financial education. Many people struggle to decide how much to invest in stocks versus bonds. This framework gives them a clear and logical starting point.

Final Word On 120 Minus Age Rule

The 120 minus age rule is a practical guide that helps investors assign the right balance between growth assets and safer assets across their lifetime. Instead of guessing, the rule sets a structure that naturally adjusts with age. Longer retirements, rising life expectancy, and inflation risks all support the use of a slightly higher equity allocation compared with past decades.

Still, the rule should not be applied blindly. Personal situations differ. Income stability, risk tolerance, family responsibilities, market experience, and financial goals all matter. Many investors prefer to treat the rule as a base model and then adjust slightly to suit their comfort level.

When used thoughtfully, the 120 minus age rule can help create a disciplined and long term investment plan that supports financial security through working years and retirement. If you want to know more about such rules you can visit:

Read More: Must Know Trading and Investment Rules for Future Millionaires in India

Tags: investing strategy, asset allocation, retirement planning, personal finance, stock market, portfolio management

Share This Post