Ten Bagger Rule: The Rare Path To 10X Returns In The Stock Market

Ten Bagger Rule: The Rare Path To 10X Returns In The Stock Market

A Ten Bagger refers to a stock that rises to ten times its original price. The term was popularised by investor Peter Lynch. He used the phrase to describe rare stocks that deliver 1,000 percent gains when held over time. The idea highlights the power of compounding and long term patience.

Key Takeaways On Ten Bagger Rule

- Ten bagger means a stock that becomes 10 times its original value.

- Term made popular by Peter Lynch in One Up on Wall Street.

- Most ten baggers begin as smaller companies with strong growth.

- Patience and discipline are essential since volatility is normal.

- Position sizing matters because gains only help when allocation is meaningful.

The Ten Bagger Rule is not a strict formula. It acts more like an investing benchmark. Investors use it to describe standout winners. Lynch compared it with baseball scoring terms, where a two-bagger means a double. A ten bagger is simply a stock that grows far more than expected due to strong business fundamentals.

Table of Contents

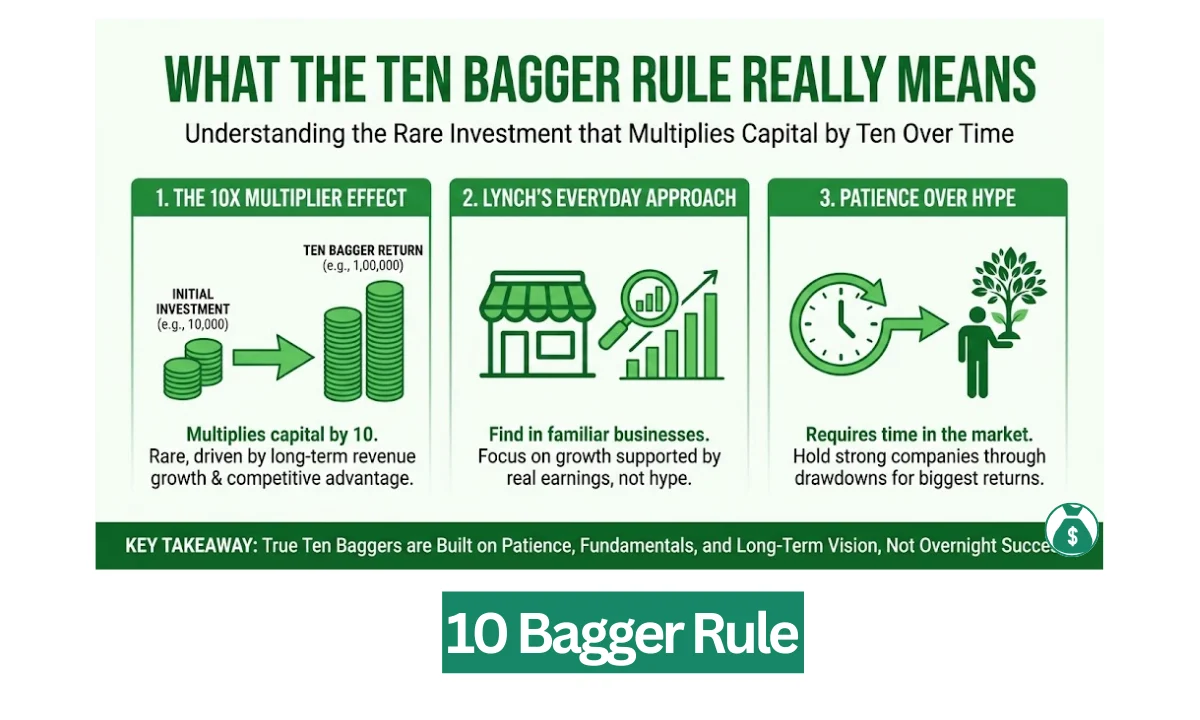

What The Ten Bagger Rule Really Means

A ten bagger stock multiplies investor capital by ten. For example, an investment of 10,000 becomes 1,00,000. This type of return is rare. It often comes from companies that expand revenue, enter new markets, or build strong competitive advantages over many years.

Peter Lynch showed that investors could find ten baggers in everyday businesses. He believed that the best ideas sometimes exist in familiar companies. His focus was on growth that is supported by earnings. Not hype.

Ten baggers do not happen overnight. They require time in the market. Lynch often held strong companies during periods of drawdown. He believed the biggest returns came from patience.

Key Traits Seen In Ten Bagger Stocks

Most ten bagger stocks share common themes. These stocks usually belong to expanding industries. They often launch innovative products. They are backed by capable management and a growing customer base.

Recent market sentiment shows rising interest in sectors like AI, space technology, insurtech, biotech, and mining. Investors mention companies like ASTS, OSCR, LMND, ATAI, PLTR, RKLB, HIMS, and JOBY as potential high-growth names. Many of these began as small companies. History shows that 87 percent of past ten baggers started as microcaps with a track record of profitability.

Investors also discuss emotional difficulty. Many ten bagger journeys involve sharp corrections. Some investors describe the process as moving through optimism, fear, and doubt before success. Holding through negative periods becomes the price of admission for large gains.

Why Most Investors Struggle To Capture Ten Baggers

Most people like the idea of a 10X return. However, very few investors hold long enough to capture it. Drawdowns of 40 percent or more can occur along the way. Many investors exit early. Others chase hype at the top.

There is also a risk of garbage stocks that rise during bull runs without strong fundamentals. These names can fall more than 75 percent when market sentiment changes. That is why discipline and analysis matter.

Another key point is position sizing. A ten bagger on a tiny allocation does not change overall wealth. Investors stress that allocation must be meaningful. Multibaggers do not create wealth unless investment size is balanced and rational.

The Role Of Fundamentals In Finding Ten Baggers

Many investors inspired by Peter Lynch focus on key fundamentals. These include strong earnings growth. Reasonable valuation. Expanding market opportunity. Competitive moat. Good capital allocation.

Some investors state a simple standard. A company that delivers 10 percent Return on Equity and 10 percent annual growth for ten years can reach ten bagger levels. Others prefer to look for companies that can at least double in three years under conservative assumptions. This approach avoids speculation.

The long term goal is to let business growth work. Not to chase momentum.

Where Investors Are Hunting For Ten Baggers Today

Recent discussions between late 2025 and early 2026 show strong search activity in several sectors:

- Mining and exploration including gold and silver juniors

- Artificial intelligence and related software platforms

- Healthcare and biotechnology

- Space technology

- High growth digital insurance and fintech names

- Profitable microcaps and strong small firms

Many investors mention stocks like ASTS, LMND, OSCR, PLTR, ATAI, RKLB, JOBY, and HIMS as potential high-growth plays. There is also chatter around crypto assets like ETH and smaller tokens where users speculate on 10X outcomes. However, experienced voices warn that hype alone is not enough.

Public Opinion On Ten Baggers Ruel

(The data is taken from x from real users) Recent investor discussions show mixed emotions. Ten baggers are admired because they can change financial lives. Investors also recognise the cost in terms of patience and stress.

People often describe the journey as emotional. First comes excitement. Then doubt. Then confidence after success. Many share stories of holding winners through difficult times. Others remind that beating the market with lower risk can also be a sound strategy.

The overall tone remains grounded. Ten baggers are possible. They are not common. Serious research and discipline remain essential.

Ten Bagger vs Multibagger

A ten bagger refers to a 10X gain. A multibagger refers to any stock that multiplies value. All ten baggers are multibaggers. However, not all multibaggers reach ten times returns. Ten baggers belong to the rare upper category of investment performance.

One Simple List To Remember When Searching For Ten Baggers

Here are core traits that many ten bagger stocks share based on past market trends and investor observations:

- Strong earnings growth supported by revenue expansion

- Reasonable valuation at entry

- Large addressable market

- Durable competitive advantage

- Competent leadership

- Smaller starting market cap

- Patience from investors during volatility

These traits improve the chance of identifying strong compounding businesses. However, they do not remove risk.

Patience And Portfolio Strategy

Holding a ten bagger often means ignoring short term noise. Investors stress the value of regular research, emotional control, and diversification. Some prefer to hold long term unless company fundamentals weaken. Others set clear rules for trimming or protecting capital.

The key message is simple. Ten baggers reward discipline. They punish panic.

Final Thoughts On Ten Bagger Rule

The Ten Bagger Rule reminds investors about the power of long term compounding. Peter Lynch showed that normal investors can find major winners when they research well and stay patient. Most ten baggers begin as smaller businesses with room to grow. They reward investors who understand fundamentals and stay invested through drawdowns.

At the same time, chasing hype without analysis can destroy capital. Real success comes from balanced allocation. Sound judgement. And a steady mindset.

Ten baggers remain rare. Yet they continue to inspire investors across the world. They stand as proof that long term ownership of quality businesses can change financial outcomes in a big way.

Also Read: Rule of 20: What the Latest Market Readings Signal for Investors in 2026

Tags: ten bagger rule, multibagger stocks, peter lynch investing, long term investing, stock market growth, value investing

Share This Post