10-5-3 Rule in Planning: A Simple Guide For Realistic Wealth Building

10-5-3 Rule in Planning: A Simple Guide For Realistic Wealth Building

Financial planning often feels complex. Many new investors enter the market with high hopes and expect large returns in a short span. The 10-5-3 Rule gives clarity. It sets practical expectations for long term returns from different asset classes and helps investors plan with calm discipline.

Table of Contents

Key Takeaways

- The 10-5-3 Rule explains expected long term annual returns.

- Equities are linked with around 10 percent expected returns.

- Debt investments are linked with around 5 percent expected returns.

- Savings and cash based instruments are linked with around 3 percent expected returns.

- The rule is a simple tool to guide asset allocation for long term goals.

Also Read: The 6 Percent Risk Rule That Traders Ignore: Protect Your Account Before It’s Too Late

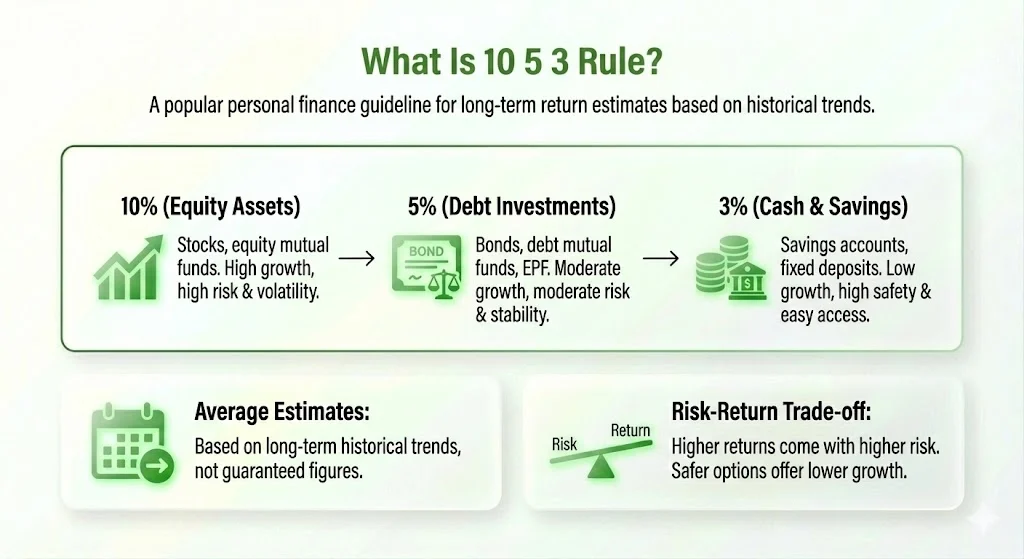

What Is 10 5 3 Rule?

The 10-5-3 Rule is also written as 10/5/3. It has become one of the most shared concepts in personal finance education. The meaning of the rule is very simple. Equity assets like stocks or equity mutual funds are expected to deliver around 10 percent returns in the long run.

Debt investments such as bonds, debt mutual funds, EPF, or similar products are expected to grow at around 5 percent. Cash and savings based instruments like savings accounts and fixed deposits usually deliver around 3 percent.

These are not guaranteed figures. They are average estimates based on long term historical trends. The key idea is that higher returns usually come with higher risk and more volatility. Safer options offer more stability, but they also give lower growth.

Why Investors Use The 10-5-3 Rule?

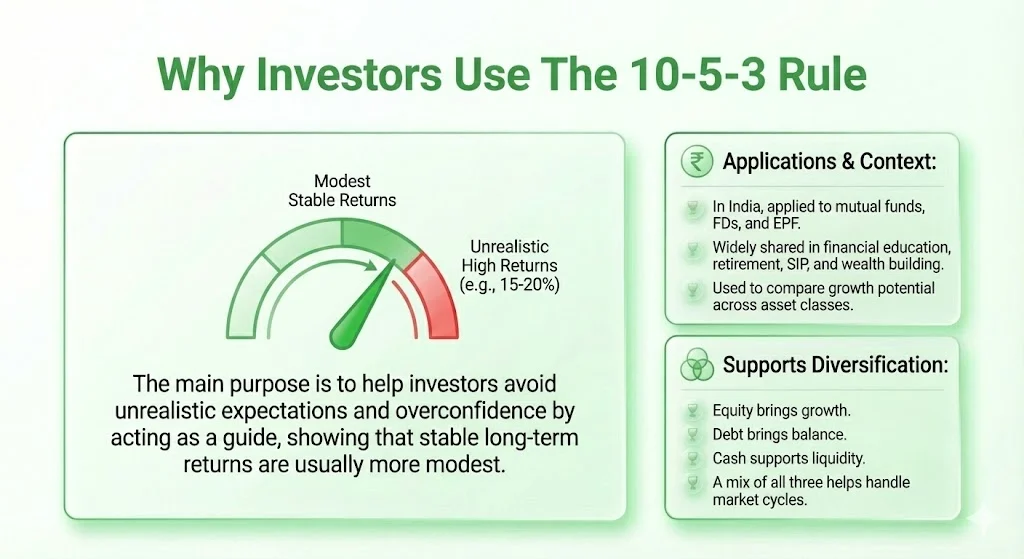

The main purpose of the 10-5-3 Rule is to help investors avoid unrealistic expectations. Many people assume that equity investments will always give 15 to 20 percent returns year after year. This often leads to overconfidence and risky behavior.

The rule works like a guide to show that stable long term returns are usually more modest.

In India, the rule is often applied to mutual funds, FDs and EPF. It is widely shared in financial education, retirement planning, SIP planning and wealth building discussions.

Investors use it to compare growth potential across asset classes. It also helps in asset allocation where a portfolio is divided across equity, debt and cash.

The rule supports diversification. Equity brings growth. Debt brings balance. Cash supports liquidity. A mix of all three helps in handling market cycles.

What The Numbers Really Mean?

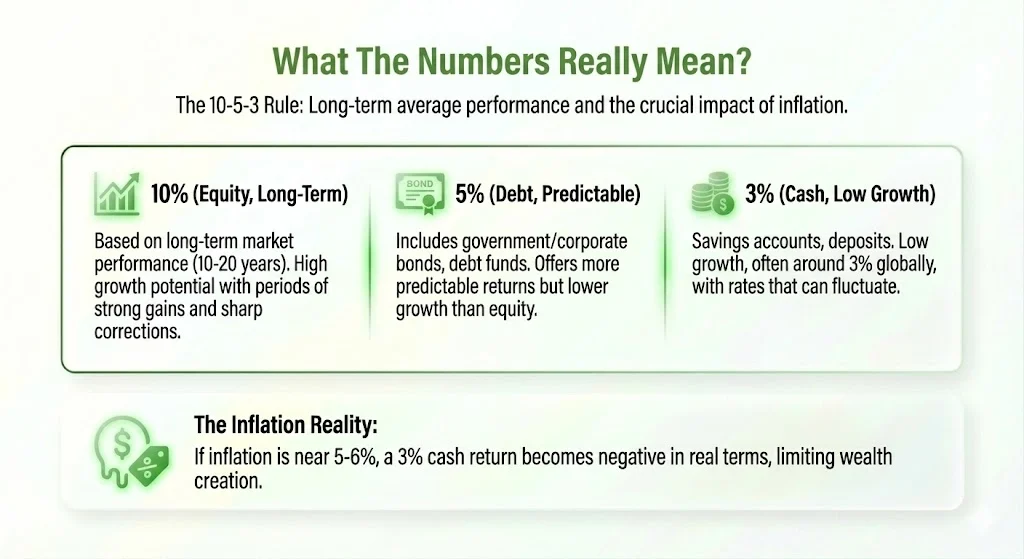

The 10 percent number for equity is based on average long term market performance. Equity investments can go through strong bull markets and sharp corrections. There can be great years with double digit growth and weak periods with negative returns. Over a span of 10 to 20 years, the average has often stayed near the 10 percent mark in many markets.

Debt investments usually deliver around 5 percent. These include government bonds, corporate bonds, and debt mutual funds. They offer more predictable returns but lower growth.

Cash based assets like savings accounts or traditional deposits grow at around 3 percent in many global contexts. In India, current FD rates may look higher in certain years. However, these periods do not always last forever. The rule focuses on long term averages.

It is also important to remember inflation. If inflation remains near 5 to 6 percent, then a 3 percent return from cash becomes negative in real terms. This highlights why parking all savings in cash instruments can limit wealth creation.

Current Trends and Public Discussions

As of early 2026, the 10-5-3 Rule continues to gain traction, especially in India. Rising awareness of inflation has pushed more investors to learn about actual real returns. Finance influencers and news platforms share the rule to explain disciplined investing.

On platforms like X (Twitter), the sentiment around the rule is largely positive. Many see it as a reality check that stops unrealistic expectations. Finance handles like ET Wealth have shared visuals explaining how the rule guides choices between mutual funds, EPF and FDs. Users often describe the rule as simple but powerful. It helps them avoid panic selling during volatile markets or chasing risky trends.

A small number of people do question the rule. Some point out that EPF rates can be higher than 5 percent. Others note that equities sometimes deliver more than 10 percent. Even then, the general view remains that the rule is meant for long term planning, not short term assumptions.

The Rule Explained In Simple Terms

The 10-5-3 Rule supports three pillars of a financial plan:

- Growth

- Stability

- Liquidity

Equities give growth. Debt gives balance. Cash gives safety and access.

Investors planning for retirement or long term wealth creation can use this rule as a starting point. It also works well for SIP planning. When you assume realistic returns, your goals remain grounded. You do not panic when markets rise or fall. You stay invested longer.

Real Life Appeal Of The 10-5-3 Rule

People admire this rule mainly for three reasons.

First, it is realistic. It stops extreme optimism. It keeps investors grounded in data based expectations rather than hype.

Second, it promotes diversification. Portfolios that mix equity, debt and cash usually handle volatility better.

Third, it supports long term thinking. Wealth creation is slow and steady. The rule keeps attention on consistency instead of shortcuts.

In India, this becomes important because many investors either avoid equity completely or expect fast returns. The rule helps them strike a healthier balance.

A Simple List Explaining Each Asset Class

- Equity or Mutual Funds

Expected return: around 10 percent in the long run

Risk level: high

Best use: wealth creation over 10 to 20 years - Debt or Fixed Income Products

Expected return: around 5 percent

Risk level: moderate

Best use: stability and predictable growth - Savings or Cash Based Investments

Expected return: around 3 percent

Risk level: low

Best use: emergency funds and liquidity

This overview shows the trade off between return and risk.

Limitations You Should Know

The 10-5-3 Rule is a guideline. It is not a promise. Markets can underperform for several years. Debt returns may rise or fall with interest rate cycles. Cash returns may move based on bank policies.

The rule does not directly include inflation or taxes. Real returns may be lower after adjustments. Risk appetite also differs from person to person. So the rule should not replace financial advice.

Still, it remains a helpful starting point for planning.

How Investors Commonly Apply The Rule

Many investors use the rule when building retirement plans. For example, expected SIP returns are calculated using 10 percent for equity funds. Conservative investors balance portfolios by dividing money between equity and bonds. Some also compare the rule with the Rule of 72 to estimate doubling time.

Global planners sometimes combine it with allocation rules like the 100 minus age guideline to decide equity exposure.

The main principle remains stable. Growth needs patience. Stability needs discipline. Liquidity needs planning.

Final Word On 10 5 3 Rule

The 10-5-3 Rule in planning is not about predicting the future. It is about setting realistic expectations. It teaches that equity can grow your wealth in the long run, but it also brings volatility. Debt balances the risk. Cash ensures safety and access.

When used with patience, the rule encourages disciplined investing. It supports diversification. It aligns planning with goals. This is why the rule continues to remain relevant, especially in a world where investors often chase quick profits.

Investors who respect this balance usually build wealth steadily over time. They do not panic during downturns. They do not become overconfident during rallies. They stay focused on the journey instead of quick outcomes.

Tags: personal finance, investing, mutual funds, financial planning, asset allocation, wealth building

Share This Post