1 Percent Risk Rule: Why 95 Percent Fail and You Will Not

1 Percent Risk Rule: Why 95 Percent Fail and You Will Not

Trading in 2026 is more active than ever. Forex, crypto, futures and prop firm accounts are seeing large volumes of new traders. Many enter the market with high hopes.

Many also leave after a few weeks because of heavy losses. Most of these losses do not come from bad market analysis. They come from poor risk control and emotional trades.

The 1 Percent Risk Rule is built to fix this problem. It is a simple rule that protects capital and keeps traders in the game for the long term. This rule has become one of the most discussed topics on trading Twitter in early 2026. It is now used by retail traders, funded account traders and even full time professionals.

Table of Contents

Key Takeaways On 1 Percent Risk Rule

- The 1 percent risk rule limits loss on any single trade

- It protects trading capital during losing streaks

- It is widely used by prop firms and professionals

- It supports discipline and emotional control

- It works for forex crypto stocks and futures

What is the 1 Percent Risk Rule?

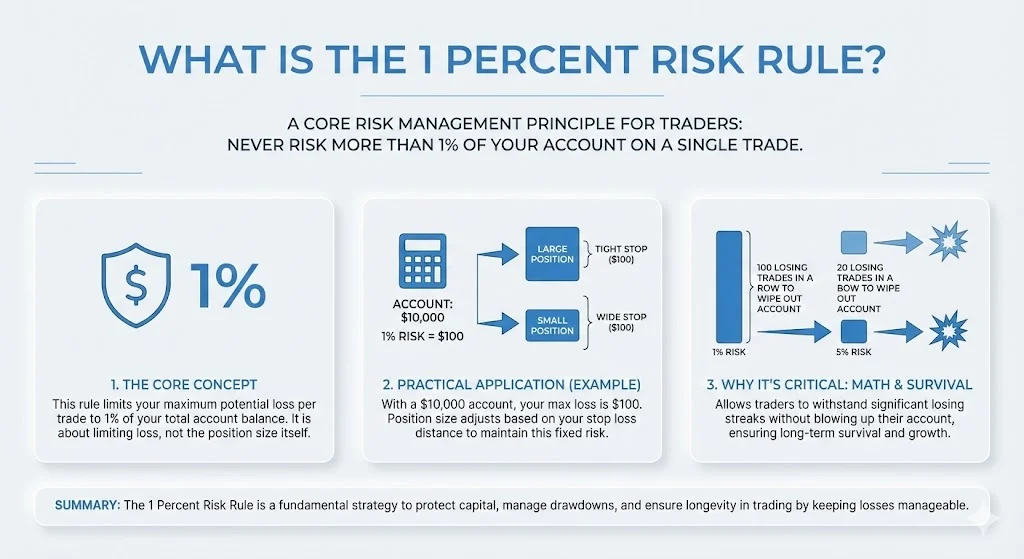

The 1 percent risk rule means you never risk more than 1 percent of your total trading account on a single trade. It does not mean you only invest 1 percent of your money. It means the maximum loss allowed if the trade fails must stay within 1 percent of your account size.

If your trading account is 10,000 dollars then 1 percent is 100 dollars. This means you are allowed to lose only 100 dollars on that trade. You can trade a larger position if your stop loss is small. You can trade a smaller position if your stop loss is wide. The risk always stays fixed.

This rule is based on math and survival. It allows traders to handle long losing streaks without blowing their account. With 1 percent risk it takes 100 losing trades in a row to wipe out an account. With 5 percent risk it takes only 20.

Also Read: 10-5-3 Rule in Planning: A Simple Guide For Realistic Wealth Building

Why The Rule Matters In 2026?

In January 2026 many traders on social media are sharing their new year trading goals. One of the top goals mentioned is mastering the 1 percent risk rule. Traders now care more about survival than fast profits.

Market volatility is still high in crypto and forex. Prop firms are stricter than before. Funded accounts now monitor lot sizes and floating losses. One wrong trade can lead to account termination. Because of this many firms like FundedNext now push the 1 percent limit for traders who show risky behavior.

The rule is also being used with other discipline tools like trade journaling, fixed risk reward ratios and emotional control systems.

Public Opinion from Trading Twitter

Here is how traders are talking about the 1 percent rule in early 2026.

| Trader View | Statement |

|---|---|

| Positive | Master the 1 percent risk rule. Most traders blow accounts not because their analysis is bad |

| Positive | The 1 percent rule lets you be wrong 60 percent of the time and still make money |

| Positive | Ten losses in a row still leaves you with 90 percent of your account |

| Prop firms | 1 percent per trade keeps traders alive and disciplined |

| Critics | Small accounts grow slower with 1 percent |

| Critics | Slippage can cause rule violations |

| Debate | Some say confident traders should risk 2 percent |

Most traders still support the rule. They see it as the base of professional trading. The main benefit they mention is calm trading. If a trade feels exciting then risk is likely too high.

How Prop Firms Use the 1 Percent Rule

Prop firms now use this rule as a filter. Traders who use large lot sizes or gamble with accounts are placed under risk control rules. These traders receive email alerts that they must now follow the 1 percent risk limit.

Once the rule is applied the trader must ensure that total risk across all open trades never exceeds 1 percent. If one trade risks 0.5 percent then another open trade can only risk 0.5 percent.

Stop losses must be used. Floating losses are tracked. If the rule is violated then profits can be removed or the account can be closed.

This system is designed to turn gamblers into professional traders.

How to Calculate the 1 Percent Risk

To use the rule you only need three numbers.

- Account balance

- Entry price

- Stop loss price

- First calculate 1 percent of your account.

- Second measure the distance between entry and stop loss.

- Third divide the risk by the stop size.

Example.

Account size 10,560

1 percent risk is 105.60

Stock entry at 125.35

Stop loss at 119.90

Stop size is 5.45

Position size = 105.60 divided by 5.45

This gives 19 shares

Even though the trade uses over 2,300 dollars of capital the actual risk is only 1 percent. This logic works the same in forex and futures. Only pip value or tick value changes.

Why The 1 Percent Rule Works

The rule is effective because it controls damage. Losing trades are part of trading. No strategy wins all the time. The goal is not to avoid losses. The goal is to keep them small.

With 1 percent risk a trader can lose 10 trades and still keep 90 percent of their account. This allows room to recover. It also removes panic and revenge trading.

The rule also allows compounding. Small steady wins grow faster over time than wild swings.

Risk Reward & the 1 Percent Rule

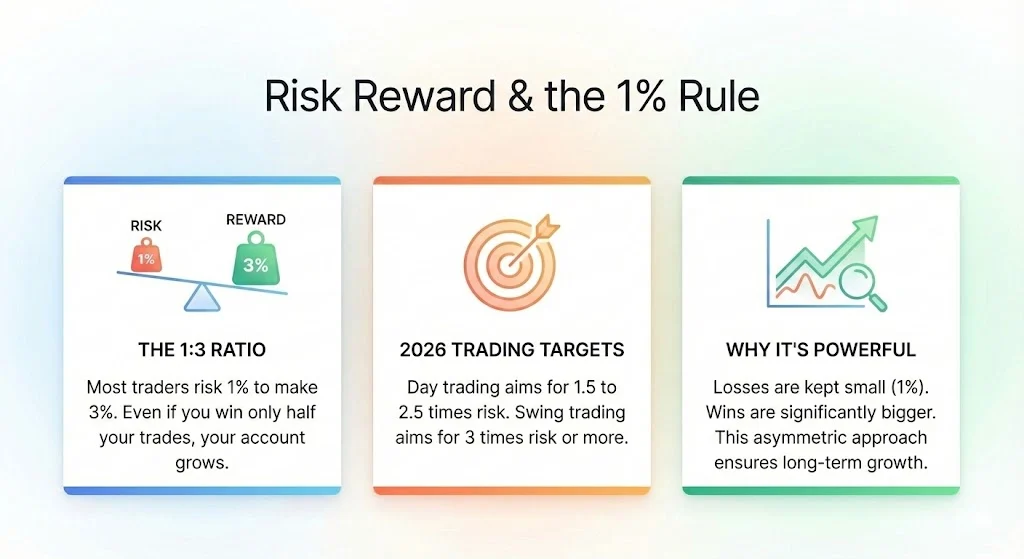

Most traders pair the rule with a 1 to 3 risk reward ratio. This means risking 1 percent to make 3 percent. Even if you win only half your trades you still grow.

Many traders in 2026 use these targets.

Day trading aims for 1.5 to 2.5 times risk

Swing trading aims for 3 times risk or more

This is what makes the rule powerful. Losses are small. Wins are bigger.

Does The Rule Limit Growth

Some traders with small accounts say 1 percent is slow. A 100 dollar account grows slowly with 1 dollar risk. This is true. But higher risk also increases the chance of total loss.

Many traders who raise risk to 5 percent never reach larger accounts. They blow the account first.

Some traders start at 2 percent when learning. Once they become consistent they move to 1 percent. This builds stability.

Slippage and Real World Risk

In prop trading slippage is a real issue. Sometimes price moves past stop loss and causes a larger loss. This can break the 1 percent rule even if you followed it.

This is why many traders avoid holding trades during major news or market close times. Gaps and fast moves increase risk.

The rule still protects better than no rule.

Using the Rule for Investing

Long term investors use a different version. They do not use stop losses. Instead they limit how much capital goes into each asset.

Many investors place 2 to 5 percent in individual stocks. Index funds get more. Risk is spread across assets.

This keeps any single failure from damaging the portfolio.

Why Disciplined Traders Love the Rule

Traders who follow the rule describe trading as boring. That is a good sign. When trades feel calm it means risk is under control.

The rule removes excitement. It replaces it with steady execution.

In 2026 the trading community is moving toward this mindset. Survival comes before profits. Capital comes before ego.

Final Thoughts

The 1 Percent Risk Rule is not about being cautious. It is about being smart. It allows traders to stay in the market long enough for their edge to work.

Whether you trade forex, crypto, stocks or prop firm accounts this rule fits every style. It keeps losses small. It keeps emotions low. It supports long term growth.

Most traders fail because they break this rule. Most profitable traders follow it every day.

Tags: 1 percent risk rule, trading risk management, prop firm trading, forex money management, crypto trading discipline, trading psychology

Share This Post