Gold Rate Today: Gold Crosses ₹1.50 Prices Break All Records as Safe Haven Rush Intensifies

Gold Rate Today: Gold Crosses ₹1.50 Prices Break All Records as Safe Haven Rush Intensifies

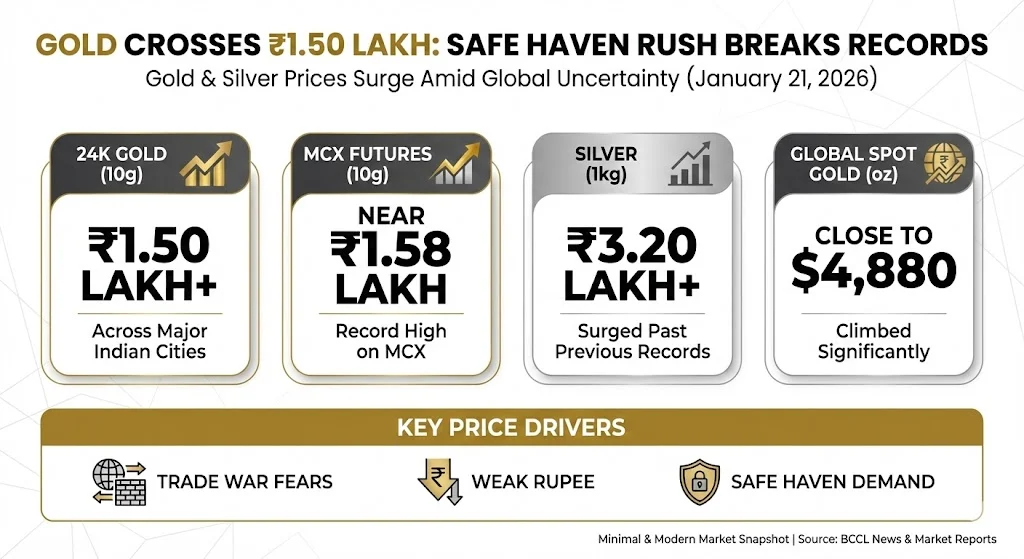

Gold rate today has shocked both investors and buyers as prices surged sharply across India and global markets. On January 21, 2026, gold crossed multiple psychological levels in a single session, creating one of the strongest rallies seen in recent years. The move reflects rising global fear, currency pressure, and a strong shift toward safe assets.

The sudden jump has triggered mixed reactions. Investors see validation of gold’s role as protection during uncertainty, while consumers face serious affordability pressure. With gold and silver hitting fresh highs together, precious metals are now at the center of global market discussion.

Table of Contents

Key Takeaways

- 24K gold crossed ₹1.50 lakh per 10 grams across major Indian cities

- MCX gold futures touched record highs near ₹1.58 lakh

- Silver surged past ₹3.20 lakh per kg

- Global spot gold climbed close to $4,880 per ounce

- Trade war fears, weak rupee, and safe haven demand driving prices

Also Read: Kalyan Jewellers Stock Falling Sharply Amid Panic Selling – Stock Hits 52-Week Low

Gold Rate Today in India on January 21, 2026

Gold prices in India witnessed a powerful rally during today’s session. Domestic prices moved sharply higher in line with global markets, supported by strong buying interest and currency weakness.

As of mid day trading, 24K gold prices were trading in the range of ₹1,54,800 to ₹1,58,339 per 10 grams. The exact rate varied based on city premiums and futures versus spot pricing. MCX gold futures hit an all time high near ₹1,58,339, while spot prices in key cities stayed slightly lower.

22K gold prices also moved higher, trading between ₹1,41,900 and ₹1,45,035 per 10 grams. Silver prices jumped alongside gold, trading between ₹3,20,000 and ₹3,34,000 per kilogram, reflecting strong demand and momentum.

Gold Prices in Major Indian Cities

| City | 24K Gold Price (₹ per 10g) |

|---|---|

| Delhi | 1,54,830 |

| Mumbai | 1,55,100 |

| Bengaluru | 1,55,220 |

Prices differ slightly due to local taxes, logistics costs, and regional demand patterns.

MCX Gold and Silver Performance Today

On the Multi Commodity Exchange, gold futures recorded one of the biggest single day gains in recent memory. Prices jumped by ₹7,000 to ₹8,000 per 10 grams, translating into a rise of nearly 4.5 to 5 percent in a single session.

Silver futures also posted strong gains, with prices rising by over ₹17,000 per kilogram during the recent rally. Market participants noted that silver continues to benefit from both safe haven buying and industrial demand expectations.

Analysts highlighted that hedging activity increased sharply as investors moved away from risk assets and into precious metals.

Global Gold Prices Hit Fresh Highs

International gold prices climbed to record levels as global uncertainty intensified. Spot gold traded in the range of $4,850 to $4,880 per ounce, marking fresh all time highs. The move came amid a weaker US dollar and rising geopolitical concerns.

Silver prices globally also remained elevated, with spot prices nearing $95 per ounce. The rally has extended gains from late 2025 into early 2026, with gold already up around 10 to 11 percent year to date in India.

What Is Driving the Sharp Rally in Gold Prices?

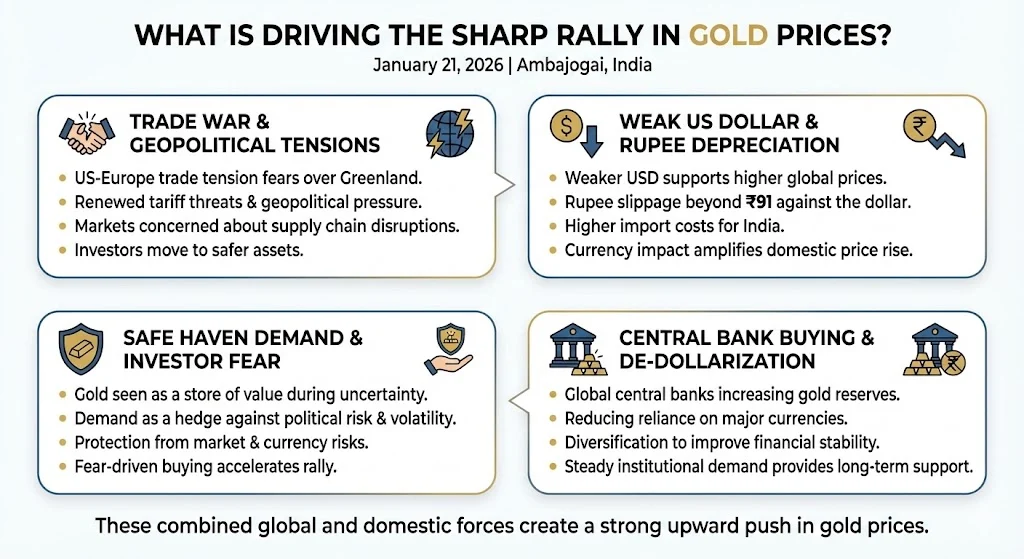

The rally in gold rate today is not driven by a single factor. Multiple global and domestic forces are working together, creating a strong upward push in prices.

1) Trade War Fears and Geopolitical Tensions

Rising tensions between the United States and Europe have shaken global markets. Statements linked to renewed tariff threats and geopolitical pressure related to Greenland have raised fears of a fresh trade conflict. Markets are concerned that prolonged trade disputes could disrupt supply chains and slow global growth.

Whenever such risks emerge, investors usually move money away from equities and into safer assets like gold.

2) Weak US Dollar and Rupee Depreciation

The US dollar has weakened against major currencies, which typically supports higher gold prices globally. At the same time, the Indian rupee has slipped beyond 91 against the dollar. Since India imports most of its gold, a weaker rupee makes gold more expensive domestically even if global prices remain stable.

This currency impact has amplified the rise in Indian gold prices.

3) Safe Haven Demand and Investor Fear

Gold is widely seen as a store of value during periods of uncertainty. With global markets facing political risks, trade tension, and policy uncertainty, demand for gold as a hedge has increased sharply. Investors are using gold to protect portfolios from volatility and currency risk.

This fear driven buying has been a major contributor to the speed and scale of the current rally.

4) Central Bank Buying and De Dollarization

Central banks around the world continue to increase gold reserves. Many are reducing reliance on major currencies and diversifying reserves to improve financial stability. This steady institutional demand provides long term support to gold prices and strengthens investor confidence during uncertain periods.

Public Reaction to Today’s Gold Price Surge ( Data From X )

Public response to gold rate today has been intense and emotional, especially on social platforms.

Many users described the move as historic, comparing current prices with past decades when gold traded near ₹18,000 or ₹63,000 per 10 grams. These comparisons highlighted long term currency erosion and inflation impact.

Investor sentiment remained largely positive. Several market participants praised gold’s performance as proof of its safe haven status. Many called it real money during times of global stress.

At the same time, frustration among consumers was visible. Many expressed concern about affordability, especially for weddings and jewelry purchases. Jewelers and goldsmiths also reported slower physical buying at such elevated levels.

Impact on Investors and Buyers

The surge in gold prices has different implications for different groups.

For existing investors, the rally offers strong portfolio protection. Gold typically performs well when equity markets face pressure, helping reduce overall risk.

For new buyers, prices at record highs increase timing risk. Buying gold during sharp spikes can limit returns if prices consolidate or correct later. Gradual accumulation is often considered a more balanced approach.

For consumers, high prices create affordability challenges. Many buyers may delay purchases or shift toward lighter jewelry or exchange schemes to manage costs.

Gold Price Outlook for the Coming Days

Market experts believe gold prices may remain firm in the near term as long as global uncertainty persists. Trade negotiations, geopolitical developments, and currency movements will continue to influence price direction.

Some analysts expect gold to inch higher toward the $4,850 to $5,000 range globally if tensions remain unresolved. Silver may remain volatile due to its smaller market size and industrial demand sensitivity.

However, experts also caution that sharp rallies can be followed by periods of consolidation. Volatility is expected to stay high.

Conclusion

Gold rate today reflects a market driven by fear, uncertainty, and currency pressure. The breakout above ₹1.50 lakh per 10 grams marks a major milestone for Indian markets and reinforces gold’s role as a defensive asset.

While investors find reassurance in gold’s performance, consumers face rising affordability challenges. The coming days will depend heavily on how global trade tensions, geopolitical risks, and currency trends evolve.

For now, gold remains the center of attention as the world navigates an increasingly uncertain economic environment.

Also Read: Deepinder Goyal Steps Down as Eternal CEO as Founder Era Enters a New Phase

Tags: gold rate today, gold price today, MCX gold, gold price in India, silver price today, safe haven assets

Share This Post