Kalyan Jewellers Stock Falling Sharply Amid Panic Selling – Stock Hits 52-Week Low

Latest Kalyan Jewellers Stock Falling Sharply Amid Panic Selling - Stock Hits 52-Week Low

Kalyan Jewellers stock falling sharply on January 21, 2026 has triggered strong reactions across the market. The shares of Kalyan Jewellers India Ltd saw intense selling pressure as investors rushed to exit positions amid broader midcap weakness and record-high gold prices.

The stock witnessed one of its steepest single-day falls in recent months, extending an already long losing streak. Despite solid business updates, market sentiment remained negative and price action continued to dominate investor decisions.

Table of Contents

Key Takeaways

- Kalyan Jewellers shares fell 12 to 14 percent in a single session

- Stock touched a 52-week low near ₹389 to ₹397 on the NSE

- Nine consecutive sessions of decline wiped out over 25 percent value

- Rising gold prices and promoter pledge concerns hurt sentiment

- Technical charts show a clear bearish trend despite strong revenue growth

Also Read: Deepinder Goyal Steps Down as Eternal CEO as Founder Era Enters a New Phase

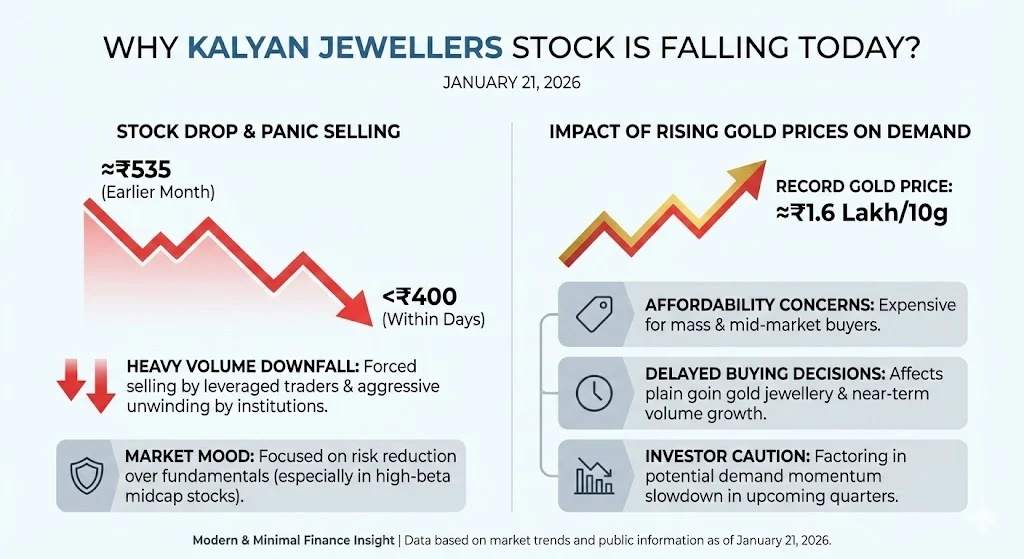

Why Kalyan Jewellers Stock Is Falling Today?

The fall in Kalyan Jewellers stock is not linked to any sudden earnings shock or regulatory issue. Instead, multiple pressure points have come together at the same time, creating a wave of panic selling.

The stock dropped from levels near ₹535 earlier this month to below ₹400 within days. Heavy volumes on the downside indicate forced selling by leveraged traders and aggressive unwinding by institutions.

Market participants are currently focused more on risk reduction than fundamentals, especially in high beta midcap stocks.

Impact Of Rising Gold Prices On Jewellery Demand

One of the biggest concerns weighing on jewellery stocks is the sharp rise in gold prices. Gold prices have surged to record levels of around ₹1.6 lakh per 10 grams, making jewellery purchases expensive for mass and mid-market buyers.

High gold prices tend to delay buying decisions, particularly for plain gold jewellery. While festive demand supported sales earlier, affordability concerns are now coming to the forefront. This directly affects volume growth expectations in the near term.

Investors are factoring in the possibility that elevated gold prices could slow down demand momentum in upcoming quarters.

Promoter Pledge Increase Raises Red Flags

Another key factor behind the fall is the increase in promoter pledge. As of December 2025, promoter pledged shares rose to around 24.89 percent compared to 19.32 percent a year ago.

Higher promoter pledge often makes investors cautious due to the risk of forced selling if stock prices fall further. Even though the company has clarified that the pledge relates to financing used for acquiring shares from Warburg Pincus, the market has remained unconvinced.

In weak market conditions, stocks with rising pledge levels tend to face sharper corrections.

Institutional Activity & Crowded Trade Unwinding

Kalyan Jewellers was one of the most crowded trades in the jewellery retail space. At its peak, the stock was trading at valuation levels that left little room for disappointment.

Some institutional investors have trimmed or exited positions in recent quarters. The exit of certain mutual funds and stake reduction by overseas investors added to selling pressure.

Retail holding in the stock remains relatively low, which means price movements are often sharper due to institutional flows. Margin calls and leveraged positions exiting the stock have further accelerated the fall.

Technical Breakdown Intensifies Selling Pressure

From a technical perspective, the chart structure has turned decisively bearish. The stock has broken below all major moving averages including 20, 50, 100 and 200-day EMA levels.

Large bearish candles with high volume suggest panic selling rather than normal profit booking. The stock is now trading well below key support zones, with the ₹440 to ₹450 range acting as a strong resistance.

Although the stock appears oversold on some indicators, momentum continues to favor the downside.

Key technical levels observed by traders

| Price Zone | Significance |

|---|---|

| ₹450 – ₹440 | Major resistance and supply zone |

| ₹400 – ₹390 | Immediate support under pressure |

| ₹390 – ₹380 | Critical demand zone |

| Below ₹380 | Risk of further downside |

A sustained break below the ₹380 zone could open the door for deeper correction if sentiment does not improve.

Strong Q3 business update ignored by the market

Interestingly, the sharp fall comes despite a strong Q3 business update. The company reported around 42 percent year-on-year growth in consolidated revenue for the December quarter.

India operations delivered same-store sales growth of about 27 percent. International operations grew by nearly 36 percent, while lifestyle and digital brand segments recorded even faster expansion.

Management also highlighted continued demand after Diwali despite volatility in gold prices. However, in the current market environment, positive fundamentals have taken a backseat.

Broader midcap weakness adds to pressure

The fall in Kalyan Jewellers stock is also part of a wider correction in midcap and consumer discretionary stocks. Risk appetite has weakened across the board as investors turn cautious amid global uncertainty and domestic valuation concerns.

Jewellery stocks are particularly sensitive to gold price volatility, making them more vulnerable during such phases. As a result, even strong companies are seeing sharp drawdowns.

What investors are watching next

Market participants are now closely tracking two key factors. The first is the direction of gold prices. Any cooling in gold rates could ease concerns around jewellery demand.

The second is the upcoming Q3 earnings call scheduled in early February. Investors will look for clarity on margins, demand trends, and balance sheet strength.

Until sentiment improves, traders expect volatility to remain high in the stock.

Overall sentiment around Kalyan Jewellers stock

The dominant mood around Kalyan Jewellers stock is negative in the short term. Fear, frustration, and caution are clearly visible among investors and traders.

While some long-term investors continue to admire the business model and growth execution, the stock action has overshadowed fundamentals. For now, the market is focused on protecting capital rather than betting on a quick recovery.

Any meaningful rebound is likely to depend on a combination of easing gold prices, stable broader markets, and confidence-building commentary from management.

Tags: Kalyan Jewellers stock, jewellery stocks India, gold price impact, midcap stock fall, NSE market news, retail stocks correction

Share This Post