EPFO 3.0: What Is Changing in PF Services And Why It Matters for Members

EPFO 3.0: What Is Changing in PF Services And Why It Matters for Members

India’s provident fund system is preparing for its biggest technology upgrade in years. EPFO 3.0 is not a small update or routine software change. It is a complete restructuring of how the Employees’ Provident Fund Organisation works at the system level.

The new version focuses on faster services, fewer office visits, and banking style convenience for PF members. With a new portal, upgraded backend, and digital payment options, EPFO 3.0 aims to remove many long standing pain points faced by salaried employees.

Key Takeaways

- EPFO 3.0 is a full scale digital overhaul, not a minor update

- PF withdrawals may become instant through UPI and mobile apps

- Claims processing is moving toward automation within a few days

- Regional language support is being added using AI tools

- Members can expect fewer office visits and faster grievance handling

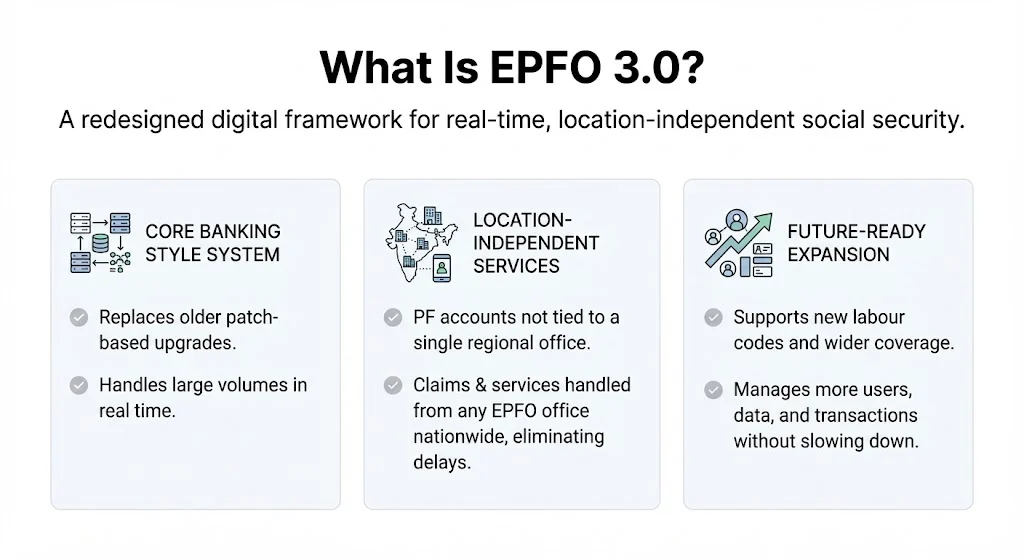

What Is EPFO 3.0?

EPFO 3.0 is a redesigned digital framework for the Employees’ Provident Fund Organisation. It replaces older patch based upgrades with a core banking style system that can handle large volumes in real time.

Under this model, PF accounts will no longer be tightly linked to one regional office. Member services like claims, corrections, and complaints can be handled from any EPFO office across the country. This change directly addresses location based delays that members have faced for years.

The upgrade is also designed to support future expansion. With new labour codes expected to widen social security coverage, EPFO systems need to manage more users, more data, and more transactions without slowing down.

Also Read: Silver ETF Momentum Holds Attention After Historic Rally and Sharp Corrections

Why EPFO Is Moving to a Banking Style System

EPFO currently manages a massive retirement corpus of over ₹28 lakh crore. It also serves more than eight crore active members. As membership grows, older systems struggle with speed and coordination.

A core banking like solution allows centralized processing, instant balance updates, and smoother transactions. This is similar to how banks handle savings accounts, transfers, and customer support.

Another key reason is expansion beyond the organised workforce. EPFO is expected to play a role in social security coverage for unorganised workers under upcoming labour reforms. A modern system is essential to manage this scale.

New EPFO Portal and Backend Upgrade

One of the most visible changes under EPFO 3.0 will be the launch of a new portal. The current interface has improved over time, but it still relies on older architecture.

The new portal will be built to handle future demand over the next decade. It will focus on mobile friendly access, faster response time, and smoother navigation. Backend software is also being rebuilt so data updates happen in near real time.

This upgrade aims to reduce system downtime, failed submissions, and repeated verification issues that members often face during claims or profile updates.

Also Read: Yes Bank Share Price Today Stays Range Bound Near ₹22 As Q3 Results Draw Mixed Views

EPF Withdrawal Through UPI and Mobile Apps

A major highlight of EPFO 3.0 is the introduction of UPI based PF withdrawals. Members are expected to withdraw eligible PF amounts directly through UPI apps like BHIM.

The system will show total balance, eligible withdrawal amount, and mandatory minimum balance. Internal discussions suggest an initial per transaction cap of ₹25,000.

This feature builds on recent simplification of withdrawal rules, where categories were reduced and online claims crossed 99 percent. For members, this means quicker access to funds without waiting for long bank processing cycles.

Expected PF Claim Settlement Time

One of the biggest complaints against EPFO has been slow claim settlement. EPFO 3.0 aims to fix this through automation.

The goal is to process most claims automatically within 24 to 48 hours. In some cases, settlement may take up to three to five days depending on verification needs. Reports suggest that around 95 percent of claims are expected to be handled without manual intervention.

Automation reduces human delays and improves consistency. It also lowers the need for repeated follow ups by members.

AI Language Support for Regional Users

EPFO serves members across multiple states and languages. Many users struggle with English only or Hindi heavy systems.

Under EPFO 3.0, AI powered language translation tools will be used to provide support in regional languages. Platforms like Bhashini are expected to help translate content and responses into local languages.

This move improves accessibility for users who are not comfortable with English. It also reduces dependency on middlemen for basic PF related tasks.

Self Correction and Real Time Account Updates

Some improvements are already visible even before the full EPFO 3.0 rollout. Members can now correct personal details like name, date of birth, marital status, and employment dates without employer approval.

Between January and December 2025, over 32 lakh profile corrections were processed using this feature. With EPFO 3.0, such updates are expected to reflect faster in e Passbooks and account summaries.

Real time payroll linked contributions are also part of the long term plan. This helps members track deposits without long delays.

Implementation Status and Expected Launch Timeline

EPFO 3.0 is currently in advanced implementation stages. Tender processes for building and maintaining the system are nearing completion, with financial vetting underway.

Phased rollout is expected to begin in the first half of 2026. Some reports suggest April to June as the window for launching UPI based withdrawal features. Officials have indicated that remaining modules under the current upgrade phase are close to completion.

Rather than a single launch date, EPFO 3.0 is likely to roll out in stages so services remain stable during the transition.

Public Reaction and Social Media Buzz

Public response on X has been largely positive. Many users describe EPFO 3.0 as a long awaited reform that brings PF services closer to banking standards.

Common reactions highlight instant UPI withdrawals, multilingual access, and reduced need for office visits. Posts in Hindi, Kannada, Tamil, and other languages show strong interest in the new portal and AI features.

Older frustration with EPFO systems still exists in memory, but current sentiment leans optimistic that the upgrade will fix many past issues.

Why EPFO 3.0 Matters for Salaried Employees

For most employees, PF is a long term savings tool that also acts as financial support during emergencies. Delays or system issues directly affect household finances.

EPFO 3.0 focuses on speed, transparency, and ease of use. Faster withdrawals, clear balance visibility, and fewer manual steps reduce stress for members.

By adopting modern technology, EPFO aims to match the expectations of a digital first workforce that is used to instant banking and app based services.

The Bigger Picture Ahead

EPFO 3.0 is part of a broader shift toward digital governance. As social security coverage expands, systems must be reliable, scalable, and user friendly.

If implemented smoothly, EPFO 3.0 could set a new standard for public sector financial services. For millions of members, it represents a move away from paperwork and delays toward faster, simpler PF management.

The coming months will be important as features roll out and real world usage begins. For now, EPFO 3.0 stands as one of the most anticipated reforms in India’s personal finance ecosystem.

Tags: EPFO 3.0, PF withdrawal via UPI, EPFO new portal, PF claim settlement, EPFO updates 2026, provident fund news

Share This Post