ITC Share Q3 Results FY26: Revenue Growth Holds Firm, Profit Impacted by One-Time Costs and Cigarette Tax Concerns

ITC Share Q3 Results FY26: Revenue Growth Holds Firm, Profit Impacted by One-Time Costs and Cigarette Tax Concerns

ITC Limited reported its Q3 FY26 results for the quarter ended December 31, 2025, showing a mixed performance across key business segments. The company delivered steady revenue growth driven by FMCG and cigarette volumes. However, net profit remained under pressure due to one-time labour code expenses and rising regulatory challenges in the cigarette business.

The results reflect ITC’s ability to maintain stability in a difficult operating environment. Investors are closely watching how the company balances strong FMCG momentum with increasing tax and cost pressures in its core cigarette segment.

Key Takeaways

- Consolidated revenue increased around 7 percent year on year

- Profit before tax and EBITDA showed healthy growth

- Net profit stayed almost flat due to one-time labour code costs

- Interim dividend of ₹6.50 per share announced

- FMCG business delivered double-digit growth

- Cigarette segment saw volume growth but faces tax risks

- Stock sentiment remains cautious due to excise duty hike

Also Read: South Indian Bank Shock Fall: 19% Crash Explained

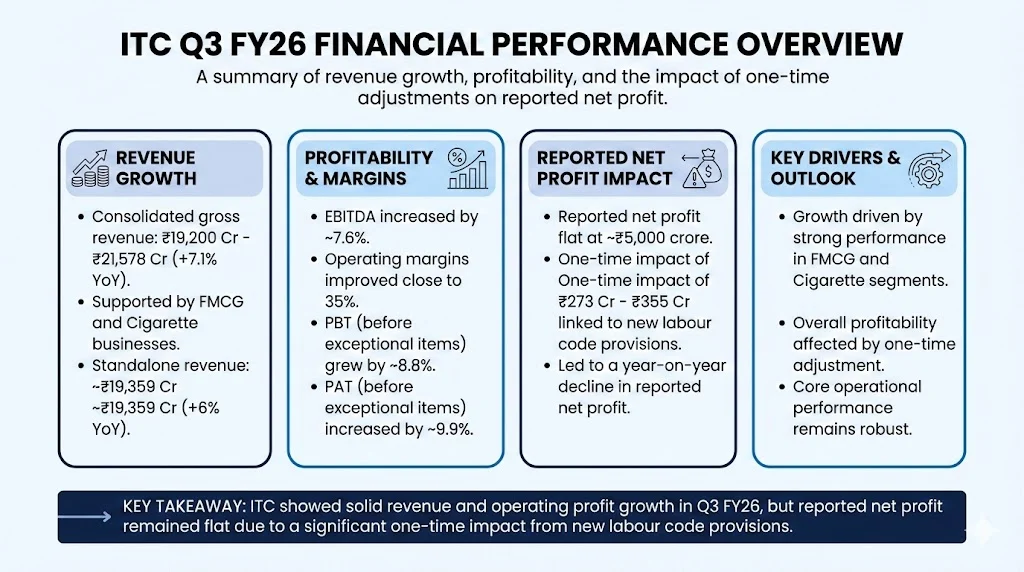

ITC Q3 FY26 Financial Performance Overview

ITC posted consolidated gross revenue in the range of ₹19,200 crore to ₹21,578 crore for the December quarter. This represents a growth of about 7.1 percent compared to the same quarter last year. The growth was supported mainly by FMCG and cigarette businesses.

Standalone revenue rose around 6 percent year on year and reached nearly ₹19,359 crore. EBITDA increased by about 7.6 percent with operating margins improving close to 35 percent. Profit before tax before exceptional items grew by nearly 8.8 percent. Profit after tax before exceptional items increased by around 9.9 percent.

However, reported net profit remained flat at around ₹5,000 crore. This was mainly due to a one-time impact of ₹273 crore to ₹355 crore linked to new labour code provisions. This adjustment affected overall profitability and led to a year on year decline in reported net profit.

Segment Wise Performance of ITC

ITC’s diversified business structure helped the company manage risks from regulatory pressure. Growth was visible in FMCG, agriculture and paperboards, while cigarettes remained stable but under stress.

The FMCG Others segment emerged as the strongest performer. Revenue from this segment grew more than 11 percent year on year. Growth came from staples, biscuits, noodles, dairy products, personal care and homecare categories. Segment profit also increased sharply due to better scale and cost control.

The cigarette business reported revenue growth of about 8 percent year on year. Volumes increased close to 6.5 percent, which was better than market expectations. However, margins were affected by higher leaf tobacco costs and rising taxes.

The agri business recorded revenue growth of around 6 percent. The paperboards, paper and packaging segment grew about 2 to 3 percent. These segments provided steady support to overall performance but did not show strong acceleration.

ITC Q3 FY26 Segment Data Table

| Segment | Q3 FY26 Revenue (₹ crore) | YoY Growth |

|---|---|---|

| Cigarettes | 8,790.76 | 8% |

| FMCG Others | 6,019.69 | 11.1% |

| Agri Business | 3,560.27 | 6.2% |

| Paperboards and Packaging | 2,202.41 | 2.7% |

| Standalone Revenue Total | 19,359.46 | 5.8% |

This table highlights the broad-based growth across ITC’s business portfolio, with FMCG leading the performance.

Impact of One-Time Labour Code Cost

A major factor affecting ITC’s Q3 net profit was the one-time expense related to new labour code implementation. This cost ranged between ₹273 crore and ₹355 crore depending on reporting basis. Without this impact, profit growth would have been stronger.

Management clarified that this cost is non-recurring in nature. It does not reflect weakness in business operations. Investors still reacted cautiously because reported net profit showed a decline despite revenue growth.

This adjustment created a gap between operating performance and final profit numbers. As a result, market response to the results remained muted.

Dividend Announcement and Record Date

Along with the quarterly results, ITC declared an interim dividend of ₹6.50 per share. The record date for the dividend is February 4, 2026. Dividend payment is expected between February 26 and February 28, 2026.

ITC continues to be seen as a strong dividend-paying stock. The dividend yield is close to 4.5 percent based on current prices. This makes the stock attractive for income-focused investors, especially during periods of market uncertainty.

The dividend also reflects ITC’s strong cash generation despite regulatory and cost challenges.

Market Reaction and Share Price Trend

ITC shares were trading close to their 52-week low around ₹318 to ₹322 during the result period. The stock has declined more than 20 percent in recent months. The fall is mainly linked to the government’s new excise duty hike on cigarettes that will come into effect from February 1, 2026.

On the day of the results, the stock showed only marginal movement. Early trade saw gains of about 1 percent, but overall reaction remained cautious.

Investors are concerned about long-term pressure on cigarette profitability. At the same time, the strong FMCG performance is providing some confidence in the company’s diversification strategy.

Public and Investor Sentiment from Social Media

Public opinion on X reflected mixed views on ITC’s Q3 performance. Many users appreciated the strong FMCG growth and dividend announcement. Some described ITC as a cash-rich company that continues to generate stable returns even when market interest is low.

Several posts highlighted cigarette volume growth of around 6.5 percent as a positive surprise. FMCG profit growth was also seen as a key strength.

However, concerns dominated around the excise duty hike. Investors warned that higher taxes could push more consumers toward illicit trade and reduce margins in the cigarette business. Some users described the stock as a falling knife due to recent price weakness.

Brokerage opinions shared online ranged from hold to cautious buy. Price targets were revised lower due to regulatory risks. Analysts advised patience until clarity emerges on pricing strategies after the tax hike.

Regulatory Pressure on Cigarette Business

The new excise duty hike on cigarettes is the biggest challenge for ITC going forward. This hike is expected to increase retail prices. It could affect demand and push consumers toward unregulated products.

Higher taxes also impact margins because raw material costs such as leaf tobacco are already elevated. Companies may need to raise prices gradually to protect profitability. This can slow volume growth in the near term.

Despite this, ITC has managed pricing actions well in the past. The company has a strong distribution network and brand loyalty. These factors can help reduce the long-term impact of regulatory changes.

FMCG Growth as Long-Term Support

The FMCG Others business has become a key pillar of ITC’s growth strategy. The segment continues to gain market share in foods and personal care. Categories such as biscuits, noodles, dairy and staples are seeing strong demand.

Profitability in FMCG has improved due to better operating leverage and cost discipline. This helps ITC reduce dependence on cigarettes over time.

Management has focused on premiumization and product innovation. This approach is expected to support steady growth in coming quarters.

Outlook for ITC Share After Q3 Results

ITC’s Q3 FY26 results show resilience but also highlight near-term risks. Revenue growth remains healthy. Operating margins are stable. Dividend payout continues to be strong.

The key concern is the cigarette tax hike and its effect on volumes and margins. This has created uncertainty in the stock’s short-term direction. Many investors prefer to wait for clarity in the next one or two quarters.

Long-term investors see value in ITC’s diversified portfolio and strong cash flows. FMCG growth provides stability. Dividend income adds support to the stock price.

Overall, ITC remains a steady but not exciting performer in the current environment. The stock may remain under pressure in the short term but could regain strength if pricing actions and FMCG growth offset regulatory challenges.

Conclusion

ITC Q3 FY26 results reflect a balance between growth and pressure. The company delivered revenue expansion across segments and maintained strong operating margins. Net profit was affected by one-time labour code costs. FMCG business stood out as the main growth driver.

Cigarette volumes remained positive but face future risks due to higher excise duty. The interim dividend of ₹6.50 per share continues ITC’s record of rewarding shareholders.

Investor sentiment remains cautious but not negative. The stock is seen as a defensive play with stable cash generation and long-term diversification benefits. Future performance will depend on how effectively ITC manages regulatory impact and sustains FMCG momentum.

Tags: ITC Q3 Results, ITC Share News, ITC Dividend, FMCG Growth, Cigarette Tax India, Stock Market Results

Share This Post