PEG Ratio Less Than 1 Rule: Why Investors Watch It Closely

PEG Ratio Less Than 1 Rule: Why Investors Watch It Closely

The PEG ratio less than 1 rule has become a popular guideline among investors who want to find growth stocks that still look reasonably priced. The PEG ratio compares a company’s price to earnings with its expected earnings growth. So it helps investors see whether the stock price makes sense when future growth is included.

Table of Contents

Key Takeaways On PEG Ratio Less Than 1 Rule

- PEG ratio compares price to earnings and growth rate

- PEG below 1 often signals undervaluation

- It is widely used for growth investing

- The metric depends on earnings estimates

- It is helpful but not perfect

A PEG ratio under 1 suggests that the stock might be undervalued relative to its growth outlook. Many investors believe this helps them find opportunities where growth momentum has not yet been fully priced in by the market. The idea became popular in part due to investor Peter Lynch, who linked PEG near 1 with fair value.

Also Read: The 80/20 Rule Or Pareto Principle Rule Explained: Small Effort Big Results

What Is the PEG Ratio?

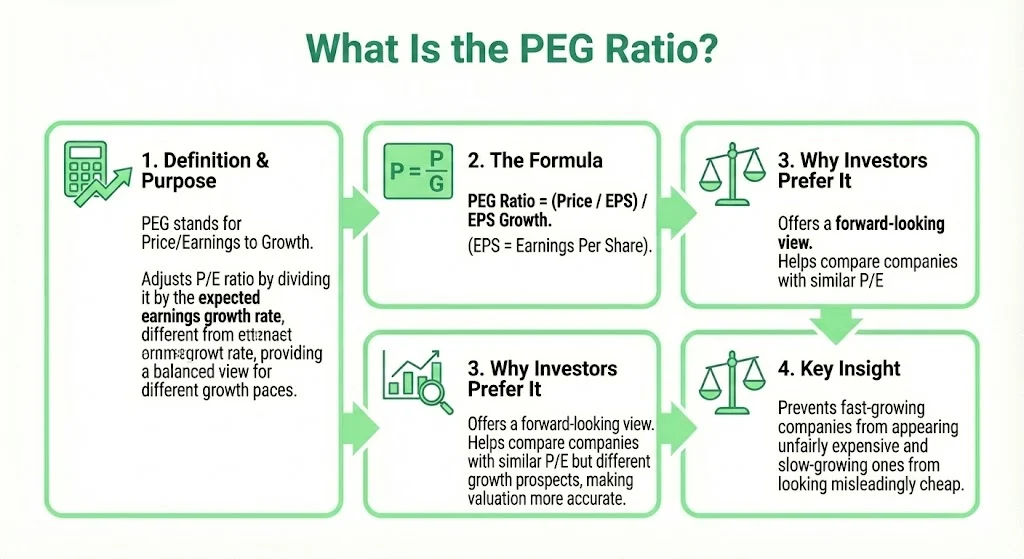

The PEG ratio stands for price earnings to growth. It starts with the P/E ratio, which shows how much the market is willing to pay for each unit of earnings. Then it divides the P/E by the expected earnings growth rate. This adjusts the valuation so that fast growing companies do not always appear expensive and slow growing companies do not always appear cheap.

PEG Ratio = (Price / EPS) / EPS Growth

EPS means earnings per share.

Many investors prefer PEG over only P/E because it gives a more forward looking view. This matters because two companies with the same P/E may have very different growth paths. PEG helps account for this.

Why PEG Ratio Less Than 1 Attracts Investors

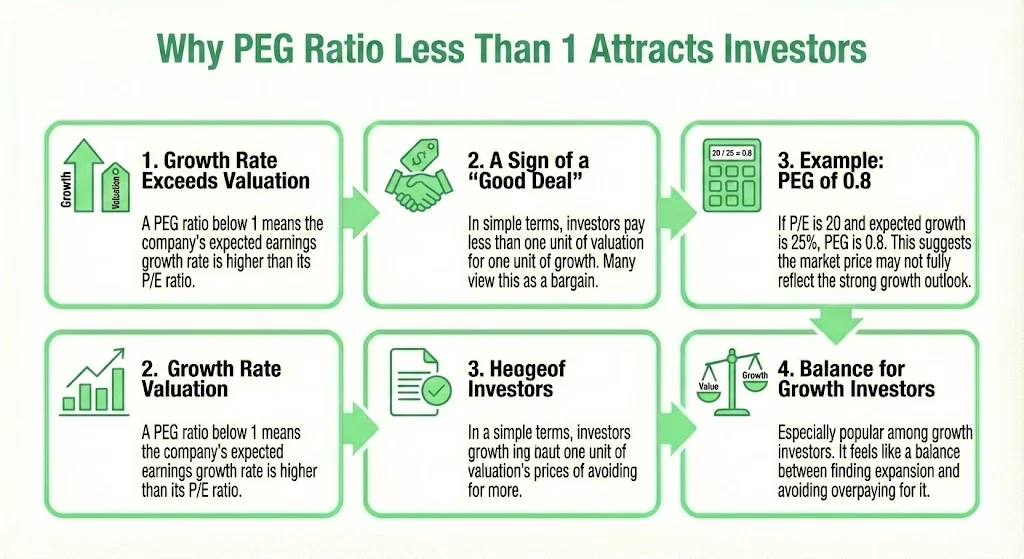

A PEG ratio below 1 means the growth rate is higher than the valuation multiple. In simple terms, investors pay less than one unit of valuation for one unit of growth. Many see this as a sign of a good deal.

For example, if a company trades at a P/E of 20 but has an expected growth rate of 25 percent, the PEG would be 0.8. This suggests that the market price may not fully reflect the growth outlook.

This rule is especially popular among growth investors. They want expansion but do not want to overpay. PEG less than 1 feels like a balance between value and growth.

Real Market Examples and Twitter Discussions On PEG Ratio Less Than 1 Rule

Recent investor discussions highlight how widely this rule is used. Many retail investors track PEG values of well known stocks. Some of the names shared often include companies like PayPal, Nvidia, Micron, AMD and tech driven players such as Oracle or Hims. Indian investors also discuss banks and small cap firms with PEG under 1, such as ICICI Bank or Bharti Airtel.

AI related stocks also feature often. Even if their P/E looks high, the PEG can still fall below 1 due to strong expected earnings growth. This leads many investors to argue that these names are undervalued on a growth adjusted basis.

Several educational posts also explain it in simple terms. PEG less than 1 means you pay less than one unit for each percentage point of expected earnings growth. This clear logic makes the ratio easy to understand.

Why Some Investors Still Remain Careful

Although many investors admire the PEG rule, others say it should only be a rough guide. Growth forecasts can be wrong. Analysts may overestimate future earnings. Economic cycles can also cause earnings to rise temporarily and then slow again.

Some investors also point out that PEG equal to 1 does not always mean fair value. The right valuation depends on interest rates, risk levels, business quality and long term assumptions. So a PEG above 1 may still be reasonable in some cases.

Markets like India have also seen periods where overall PEG levels rise very high. In such times, chasing every PEG under 1 may not always give the best results.

Comparing P/E and PEG

The P/E ratio is simple. It compares price with earnings. But it does not tell you anything about growth. So a fast growing company may look expensive on P/E terms even if it continues to expand strongly. A slow growing company may look cheap but offer less upside.

PEG improves on this by including growth expectations. So it offers a more complete view than P/E alone. Still, it depends on the accuracy of earnings forecasts.

When PEG Ratio Works Best

The PEG ratio works well for companies with steady and predictable earnings growth. These are usually firms with stable businesses, strong demand and consistent profit trends. In such cases, the earnings outlook is easier to estimate.

However, it may not work well for cyclical sectors, very early stage companies, or industries where profits move sharply. In such situations, earnings growth numbers may not reflect long term reality.

When PEG Less Than 1 May Be Useful

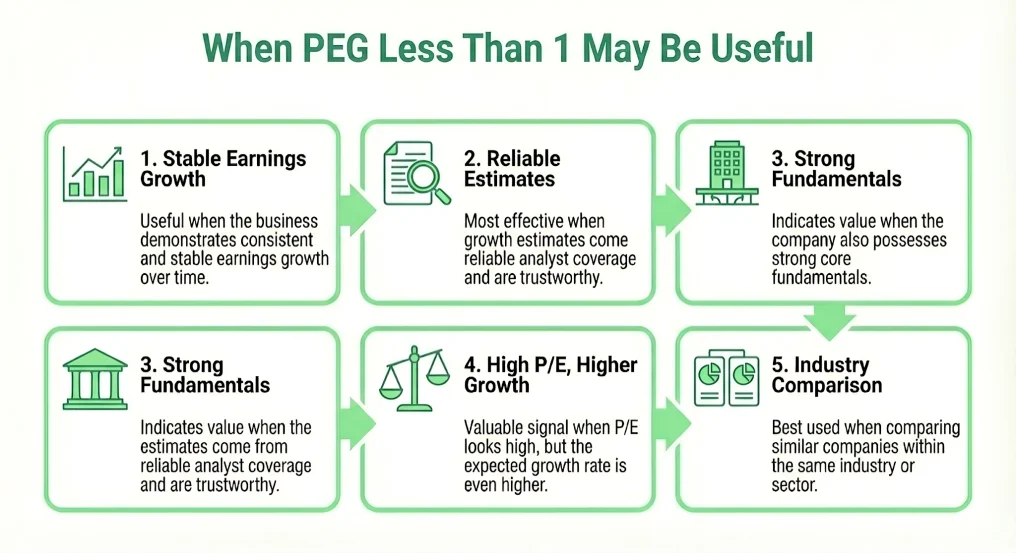

- When the business has stable earnings growth

- When estimates come from reliable analyst coverage

- When the company has strong fundamentals

- When P/E looks high but growth is even higher

- When comparing similar companies in the same industry

Limitations You Should Remember

A low PEG ratio does not guarantee a good investment. It only reflects price relative to expected growth. If the growth does not happen, the valuation case weakens.

PEG also does not include other important factors. These include debt, free cash flow, return on equity, competitive advantage and management quality. So investors usually combine PEG with other ratios.

Search and Investor Sentiment Trends

Search data suggests that the term “PEG ratio less than 1” has positive associations. Investors often search phrases like “PEG undervalued” or sector specific PEG screens. On social platforms, many users share lists of stocks that trade below 1 on PEG basis.

This trend shows strong investor interest in value plus growth ideas. Many market watchers believe this reflects a shift away from purely momentum driven investing.

Final Thoughts On PEG Ration Less Than 1

The PEG ratio less than 1 rule remains a widely used idea in stock valuation. It helps investors compare price with both current earnings and future growth. Many investors believe a PEG under 1 signals undervaluation, especially for growth focused companies.

However, the ratio depends on earnings estimates. These estimates may change with time. So PEG works best as a starting point rather than the only decision tool. When combined with other financial metrics, it can help investors identify stocks that offer growth at a reasonable price.

Also Read: Must Know Trading and Investment Rules for Future Millionaires in India

Tags: PEG ratio, stock valuation, growth investing, undervalued stocks, financial ratios, investing basics

Share This Post