Rule of 20: What the Latest Market Readings Signal for Investors in 2026

Rule of 20: What the Latest Market Readings Signal for Investors in 2026

The Rule of 20 is one of the most familiar stock market valuation tools used by analysts and long term investors. It gives a quick way to judge whether the market looks cheap, fair, or stretched.

The method is simple. You add the S&P 500 price to earnings ratio with the year over year inflation rate. If the total is close to 20, the market is considered fairly valued.

Key Takeaways On Rule Of 20

- The Rule of 20 adds the P/E ratio to the annual inflation rate

- A total near 20 signals fair value

- A reading below 20 suggests undervaluation

- A reading above 20 indicates overvaluation risk

- The latest reading reported for December 2025 was 29.4

- Analysts caution that valuations remain high going into 2026

The second paragraph of the introduction explains why this matters now. As 2026 begins, the Rule of 20 has become a key reference point again. Analysts and market watchers on X continue to discuss whether U.S. equity valuations can stay high.

The latest reported reading at the end of December 2025 was 29.4. This figure was highlighted by Liz Ann Sonders, Chief Investment Strategist at Schwab. That level sits far above the long term average of around 20 and points to expensive market conditions.

Table of Contents

What the Rule of 20 Measures

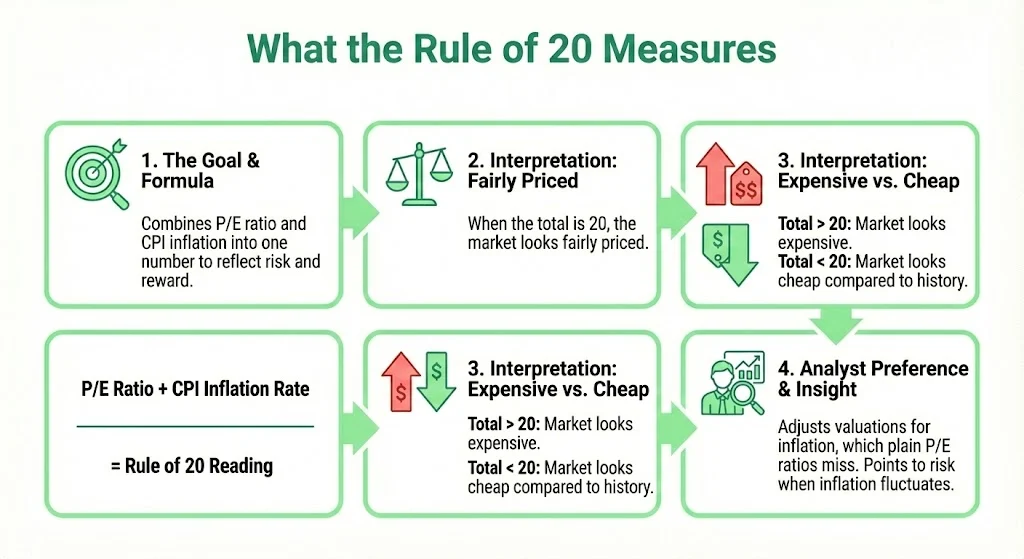

The Rule of 20 has one goal. It helps investors compress market valuation and inflation into one number that reflects risk and reward conditions. The formula is simple.

P/E ratio + CPI inflation rate = Rule of 20 reading

When the total is 20, the market looks fairly priced. When the total is higher than 20, the market looks expensive. When the total is under 20, the market looks cheap compared with history.

Analysts often prefer this rule because it adjusts valuations for inflation. Plain P/E ratios do not account for changing price levels. The Rule of 20 helps point to risk during periods when inflation moves above or below normal ranges.

Also Read: Ten Bagger Rule: The Rare Path To 10X Returns In The Stock Market

Where the Reading Stands Entering 2026

Recent commentary shows that valuations remain high. The December 2025 Rule of 20 reading came in at 29.4. That means the combined total of inflation and P/E remains far above fair value territory.

Public market discussion suggests the key driver is still elevated earnings multiples. Inflation has moderated from earlier peaks. However, P/E ratios remain high due to strong performance in mega cap technology names and rising expectations around AI growth themes. This combination leaves little valuation cushion.

Market strategists expect S&P 500 returns in 2026 to be more modest than recent years. Many forecasts now range near 6 to 9 percent. This contrasts with several previous years when returns exceeded 20 percent. Analysts argue that high valuations tend to weigh on future performance.

Historical Context and Long Term Average

The Rule of 20 is built on long term historical observation. Over many decades, the reading has hovered near 20 on average. There have been long periods above and below that level. However, markets tend to revert back toward the long term mean over time.

History suggests that extended periods above 20 have often signaled increased risk. Examples include the late 1990s and other speculative phases. When the reading has dropped below 20, returns have often been stronger in later years. Notable examples include 2009 and 2020 when conditions aligned with major market lows.

Investors using the rule do not treat it as a timing tool. Instead, it is seen as a guidepost for long term risk management.

What Investors Are Saying Online

Discussions on X show a cautious tone among serious investors and analysts. Many view the Rule of 20 reading as a warning signal. They argue that valuations matter, even when earnings resilience remains strong. Others highlight that investors may have become too optimistic about AI related growth themes.

A smaller group believes traditional valuation models are less useful in the modern market. They argue that structural changes, lower interest rate expectations, and higher profit margins may justify higher valuations. However, most conversations still acknowledge that a reading near 30 means risk is elevated.

Some investors highlight that the Rule of 20 is simple and objective. They like that it avoids emotional narratives and focuses on core fundamentals.

Why the Reading Remains Elevated

The market has seen continued concentration in large technology companies. These stocks trade at higher earnings multiples. Strong earnings and enthusiasm around artificial intelligence investment themes continue to support valuations.

Corporate earnings have also stayed resilient. This has allowed investors to justify higher prices. However, the combination of high valuations and moderate inflation leaves the Rule of 20 well above its historical norm.

Analysts explain that this pattern may cap upside returns. It can also increase sensitivity to negative earnings surprises.

One Key List of Reasons Analysts Track the Rule of 20

- It adjusts valuations for inflation

- It reflects long term investor sentiment

- It highlights periods of excessive optimism or fear

- It provides historical comparison over several decades

- It can support risk management decisions

Comparisons With Other Popular Valuation Metrics

Investors often discuss the Rule of 20 alongside the Buffett Indicator, Shiller CAPE ratio, and other valuation tools. Many of these models currently signal elevated market valuation levels. Some analysts note that these readings tend to conflict at times. Others believe that when several indicators all point higher than normal, risk increases.

There is also ongoing debate over forward versus trailing P/E. Some investors believe that strong earnings growth in 2026 could bring the Rule of 20 reading down without a decline in prices. This would require both stable inflation and rising company profits.

What the Market Might Expect From Here

No single metric predicts short term price moves. However, prolonged periods of high valuations often lead to lower future returns. Analysts warn that this pattern may repeat if earnings fail to meet high expectations.

Many long term investors do not view the current period as a crash warning. Instead, they see the Rule of 20 as a sign that risk and return may be less favorable than in previous years. This is especially important for new buyers entering the market at elevated levels.

Some investors continue to hold diversified portfolios. Others tilt exposure toward sectors with lower P/E ratios. A smaller group continues to favor high growth leaders, believing AI trends will support profits for years.

Rule Of 20 Public Sentiment And Market Psychology

The tone around the Rule of 20 discussion reflects a broader shift in mood. There is respect for recent resilience in company earnings. There is also admiration for analysts who continue to focus on fundamentals rather than hype.

At the same time, many believe high valuation readings remove the cushion that normally supports the market during downturns. This leaves less room for policy mistakes or earnings weakness.

Investors comparing today with earlier cycles note that markets can remain expensive for longer than expected. However, history also shows that valuations do matter over full economic cycles. ( This data is taken from X.com )

Final Outlook as 2026 Begins

The Rule of 20 remains a useful tool for understanding long term valuation conditions. With the latest reading at 29.4, the signal reflects a clearly overvalued market compared with history. Inflation has eased, but earnings multiples remain high. Analysts expect more moderate S&P 500 returns in the year ahead.

Public opinion on X leans cautious, though not outright bearish. Some investors believe strong innovation trends justify higher valuations. Others continue to rely on traditional valuation discipline. What most agree on is clear. The Rule of 20 reminds investors that fundamentals and inflation still shape long term returns.

For now, the message is simple. The market is priced for optimism. The margin for error is thin. Long term investors may continue to track the Rule of 20 as an important reference point through 2026.

Tags: Rule of 20, stock market valuation, S&P 500 analysis, inflation and markets, investment strategy, market outlook 2026

Share This Post