Rule of 72 In Stock Market: A Simple Way To Estimate Wealth Growth

Rule of 72 In Stock Market: A Simple Way To Estimate Wealth Growth

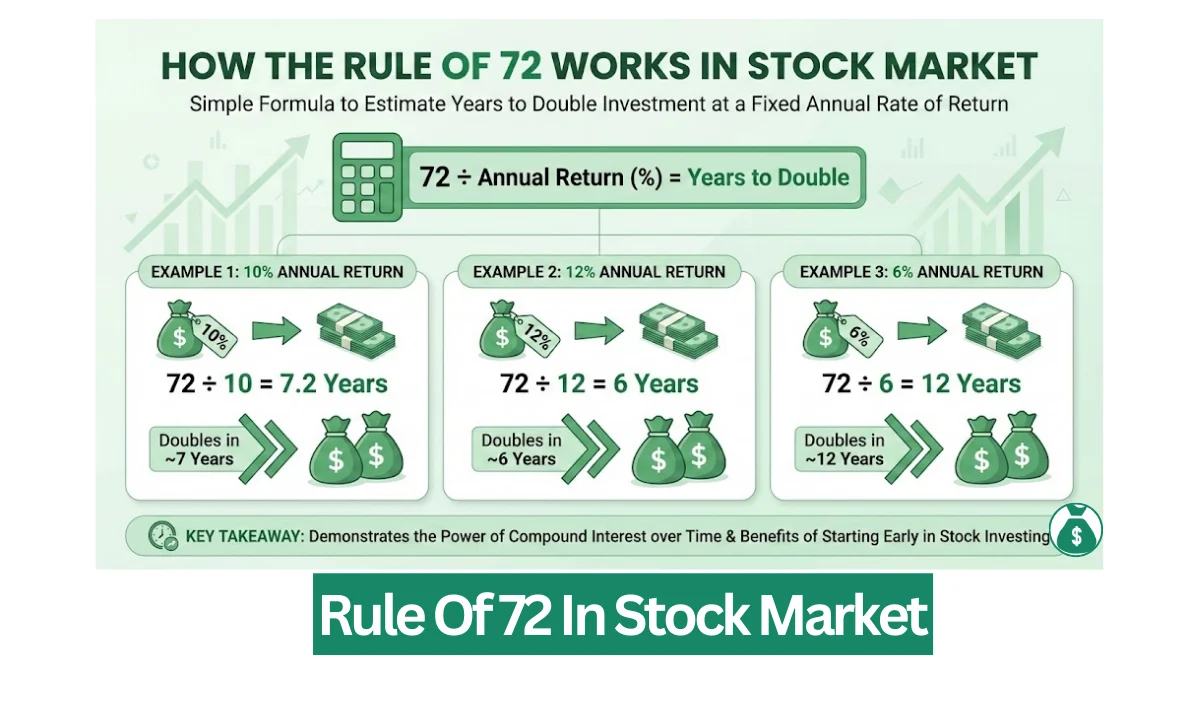

The Rule of 72 is one of the most popular shortcuts used in the stock market to understand the power of compounding. It helps investors estimate how long it will take for an investment to double in value. You only divide 72 by the annual rate of return to get the approximate number of years needed for your money to double.

Key Takeaways

- Rule of 72 helps estimate the time required for investments to double.

- Investors divide 72 by the expected return percentage.

- It works best for returns between 6% and 10%.

- It is a simple guide, not a guarantee.

- Widely used in stock market education and retirement planning.

The concept is trending strongly again in 2025 and early 2026. This comes after strong market performance and rising investor interest in long term wealth building. The rule is simple to remember, and many investors now use it to compare returns from stocks, mutual funds, gold, bonds, and bank deposits.

Also Read: The 4 Percent Rule In Stock Market: Benefits, Limitations & Public Opinion

What Is The Rule of 72?

The Rule of 72 is a simple financial rule that estimates how long it will take an investment to double in value at a fixed annual rate of return. You divide 72 by the expected yearly return rate. The answer gives you the approximate number of years needed to double the invested amount.

If an investment earns 12% per year, then:

72 ÷ 12 = 6 years

So the money doubles in about 6 years.

Many investors use it because it does not require any calculator or complex formula. It is easy to apply during planning and comparison of investment options.

How The Rule of 72 Works In Stock Market

Stock market returns are not fixed every year. But the rule helps investors understand what kind of average return is needed over time to double wealth.

Historically, major equity indexes such as the S&P 500 have delivered average returns near 10 to 12% annually over long periods. So investors often use these numbers in the Rule of 72.

At 10% annual return:

72 ÷ 10 = 7.2 years

Your investment doubles in about 7 years.

At 12% annual return:

72 ÷ 12 = 6 years

Your investment doubles in about 6 years.

At 6% annual return:

72 ÷ 6 = 12 years

Your investment doubles in about 12 years.

These simple estimates show why stock investing is powerful over longer periods and why starting early benefits investors.

Why The Rule of 72 Is Trending Again

In 2025 the stock market delivered strong performance. The S&P 500 gained about 17% in the year. In early 2026 many investors on social platforms began using the Rule of 72 again to highlight compounding growth.

People use it for:

- Explaining long term equity investing

- Comparing stocks to fixed deposits

- Understanding retirement wealth growth

- Motivating disciplined saving

- Showing the benefit of high returns

Several users highlighted how investments at 12% can double in nearly 6 years. Others compared asset classes like Nifty 50, large cap, and small cap returns. Many also used real life stories such as retirement accounts doubling every few years to inspire others.

Quotes from investor legends like Peter Lynch also strengthened interest in the concept.

Rule of 72 Examples In Stock Market

Here is a simple listicle to show different doubling periods based on return rates:

| Annual Return Rate | Years To Double (Rule of 72) |

|---|---|

| 6% | 12 years |

| 8% | 9 years |

| 10% | 7.2 years |

| 12% | 6 years |

| 15% | 4.8 years |

This simple view helps explain why even small increases in annual returns can lead to major differences in wealth over time.

Uses Of Rule of 72 In Stock Market

Investors use the rule in several ways:

- To estimate the time needed to double portfolio value.

- To calculate the return required to double money within a target period.

- To compare stock market returns with bank deposits and bonds.

- To understand how inflation reduces purchasing power.

- To plan retirement goals.

For example, if an investor wants to double money in 8 years, then:

72 ÷ 8 = 9%

So the investment needs about 9% average return per year.

Connection With Inflation And Wealth Erosion

The Rule of 72 is also used for inflation. Instead of showing how fast money grows, it shows how fast purchasing power reduces.

If inflation is 6%:

72 ÷ 6 = 12 years

Money loses half its value in 12 years.

So the rule reminds investors that cash loses value if not invested.

Accuracy Of Rule of 72

The Rule of 72 works best for returns between 5% and 10%. At very high or low rates there can be slight variation. Still, investors prefer it because it is fast and reliable enough for planning.

The rule assumes:

- Constant return rate

- Compounding occurs

- No withdrawals

- Reinvestment continues

In reality stock markets fluctuate. So the actual doubling time can change depending on volatility, taxes, fees, and timing.

Limitations Of Rule of 72

The Rule of 72 is only an estimate. It does not guarantee returns. Real markets move up and down. There may be bull markets or long flat periods. A few investors also point out that expecting high returns like 9 to 12% may be unrealistic in some market conditions.

So the rule should be used only as a guiding tool.

Why Investors Love The Rule of 72

Investors admire the rule because it:

- Explains compounding in simple form

- Encourages long term mindset

- Shows the impact of return rate

- Helps in comparing assets

- Motivates early investing

It is also used widely in financial education material, investment threads, and wealth planning posts.

Rule of 72 In Current Market Sentiment

In early 2026 discussions about Rule of 72 increased again. This rise is linked to increasing retail participation, strong equity performance, and growing interest in financial literacy. Many investors believe it helps people stay invested instead of panic selling.

Analysts expect average stock returns to be around 3 to 15% in 2026. So the rule is being used to keep expectations realistic. At 10% return, doubling still needs around 7 years.

Final Thoughts

The Rule of 72 remains one of the most simple and powerful concepts in the investing world. It helps investors understand how compounding works and how long it may take to double wealth at different return levels.

While it is not a guarantee, it provides a quick and clear direction for financial planning. With rising market awareness, the rule continues to guide new and experienced investors toward disciplined and long term investing.

Read About Must Know Trading and Investment Rules for Future Millionaires in India

Tags: Rule of 72, Stock Market Education, Compounding Returns, Long Term Investing, Financial Planning, Investment Basics

Share This Post