Silver ETF Momentum Holds Attention After Historic Rally and Sharp Corrections

Silver ETF Momentum Holds Attention After Historic Rally and Sharp Corrections | Image With invetopedia

Silver ETFs have remained in strong focus after one of the most aggressive rallies seen in any asset class in recent years. The move during 2025 reshaped how investors look at silver as both an industrial metal and a store of value. Even after recent sharp corrections, interest in silver ETFs has not faded. Instead, market participation has shifted from disbelief to selective buying during dips.

The discussion around silver ETFs is no longer limited to short term price action. Investors are now evaluating supply deficits, industrial demand, global policy shifts, and how exchange traded funds track the underlying metal during volatile phases.

Key Takeaways

- Silver ETFs delivered exceptional gains in 2025, outperforming most asset classes

- Structural supply deficits and industrial demand played a major role in the rally

- Sharp ETF corrections triggered debate but did not break long term optimism

- 2026 outlook points to higher volatility with more moderate returns

- Dip buying and caution now coexist in investor sentiment

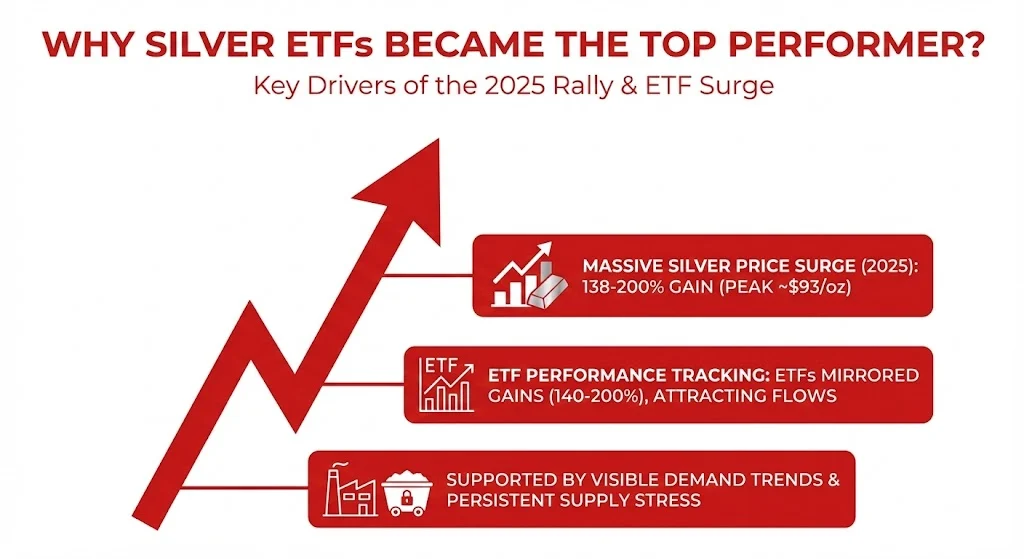

Why Silver ETFs Became the Top Performer?

Silver emerged as one of the strongest performing assets during 2025. Prices surged roughly 138 to 144 percent during the year, with some estimates placing the move closer to 200 percent from early year lows to peak levels near 93 dollars per ounce. This performance placed silver ahead of gold, which rose around 64 to 74 percent in the same period.

Silver ETFs tracked this move closely. Products such as iShares Silver Trust recorded gains ranging from 140 to 200 percent over a twelve month period. These returns pushed silver ETFs into mainstream attention, attracting retail and institutional flows at the same time.

Unlike earlier silver rallies driven mainly by speculation, the 2025 move was supported by visible demand trends and persistent supply stress.

Structural Supply Deficit Supporting Prices

One of the strongest pillars behind silver ETF performance has been a deepening supply deficit. Market estimates indicate a deficit of nearly 118 million ounces during 2025, with expectations that shortfalls will continue into 2026.

Mine supply growth has remained limited, recycling flows have not expanded meaningfully, and above ground inventories have tightened. Physically backed silver ETFs absorbed large quantities of metal during the rally. Data points to ETF inflows absorbing roughly 134 million ounces during 2025 alone.

This absorption reduced available supply in the open market and added upward pressure on prices, which directly reflected in ETF valuations.

Also Read: EPFO 3.0: What Is Changing in PF Services And Why It Matters for Members

Industrial Demand Changed the Narrative

Silver’s industrial use played a major role in changing investor perception. Demand from solar energy installations, electric vehicles, electronics, AI hardware, and battery technologies remained strong throughout the year.

These sectors continued expanding regardless of short term market noise. This created a demand base that was not dependent on fear or risk off sentiment. For silver, this was a major shift. It introduced a functional demand floor that had often been missing in past cycles.

ETF investors responded by treating silver less as a pure trading instrument and more as a strategic allocation linked to future technologies.

Volatility Remains Part of the Trade

Silver has always been volatile, and the recent cycle did not change that trait. After the record rally, silver ETFs witnessed sharp drawdowns in short periods. Some ETFs dropped between 10 and 20 percent in a single session even when spot silver prices remained relatively stable.

This created confusion among retail investors. Many market participants described these moves as premium corrections or tracking adjustments rather than true breakdowns in silver’s value.

Experienced traders pointed out that silver rarely corrects in a controlled manner. Historically, pullbacks of 30 to 50 percent have occurred even during strong bull markets. The recent corrections fit that long established pattern.

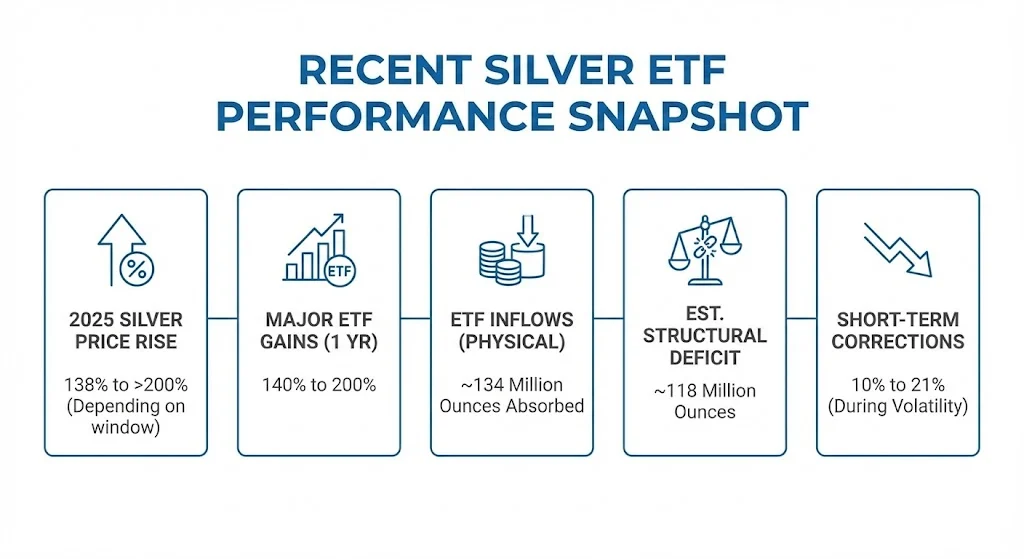

Recent Silver ETF Performance Snapshot

- 2025 silver price rise ranged from 138 to over 200 percent depending on measurement window

- Major silver ETFs delivered gains between 140 and 200 percent over one year

- ETF inflows absorbed approximately 134 million ounces of physical silver

- Structural market deficit estimated near 118 million ounces

- Short term ETF corrections reached 10 to 21 percent during volatile sessions

What Triggered the Recent ETF Sell Off

The sharp drop in silver ETFs during January 2026 followed easing geopolitical concerns. Earlier tensions had pushed safe haven demand higher, supporting both gold and silver prices. When tariff threats and geopolitical risks cooled, precious metals saw immediate retracement.

Silver ETFs mirrored this pullback quickly. In some markets, silver ETFs declined more than the spot metal itself. This raised concerns about tracking accuracy and liquidity during high volatility phases.

At the same time, profit booking was expected after such a large run. Many traders who entered early in 2025 locked in gains once momentum slowed.

Investor Sentiment Has Shifted ( Data From X )

Public discussion around silver ETFs now reflects a more mature phase of the cycle. During early stages of the rally, skepticism dominated. As prices climbed, disbelief turned into late participation. Now, sentiment shows a mix of optimism and restraint.

A large group of investors views dips as buying opportunities. Common opinions stress gradual accumulation instead of aggressive lump sum buying. Many highlight silver’s long term role and advise against panic selling during short term corrections.

At the same time, caution is rising. Questions around ETF structure, physical backing, and brokerage execution during volatile sessions are more frequent. Some investors prefer physical silver, citing concerns over ETF premiums and market mechanics.

Silver ETFs Versus Gold ETFs

Silver ETFs are often compared with gold ETFs during market discussions. Gold continues to enjoy strong central bank support and lower volatility. Silver, on the other hand, offers higher upside potential but comes with sharper drawdowns.

Silver’s dual role as an industrial and precious metal gives it a different risk profile. During strong growth phases, silver tends to outperform gold. During risk off periods, gold usually holds ground better.

This contrast has led many investors to view silver ETFs as a tactical or satellite allocation rather than a core holding.

Outlook for Silver ETFs in 2026

The outlook for silver ETFs into 2026 remains constructive but less explosive than 2025. Structural deficits are expected to persist. Industrial demand remains firm. Potential interest rate cuts by the US Federal Reserve could lower the opportunity cost of holding non yielding assets like silver.

At the same time, analysts expect higher volatility and more frequent corrections. After a parabolic rally, markets often enter a consolidation phase. Long term return expectations are more moderate, closer to historical averages of 5 to 6 percent annually after major cycles.

Optimistic forecasts suggest silver could test higher levels near 100 to 120 dollars in favorable conditions. These scenarios depend on sustained demand and continued supply constraints rather than speculative momentum.

Strategic Approach Investors Are Adopting

Investors are increasingly favoring phased entries instead of chasing highs. Systematic investment approaches and buying during underperformance phases are common themes in recent discussions.

There is also rising interest in diversified silver exposure. Some investors prefer ETFs backed by physical silver. Others look at miner based ETFs or blended structures combining metal and producers.

This diversification reflects a growing understanding of silver’s cyclical nature and the need to manage volatility.

Final Thoughts

Silver ETFs have moved from the fringe to the center of market conversations. The extraordinary rally of 2025 established silver as a serious contender among global assets. Corrections since then have not erased the structural case but have reminded investors of silver’s inherent volatility.

The current phase is marked by balance. Optimism remains intact, but blind enthusiasm has faded. Silver ETFs are now viewed as high potential instruments that demand patience, discipline, and risk awareness rather than short term speculation.

Tags: silver etf, silver price outlook, precious metals investment, commodity etfs, silver market analysis, gold vs silver

Share This Post