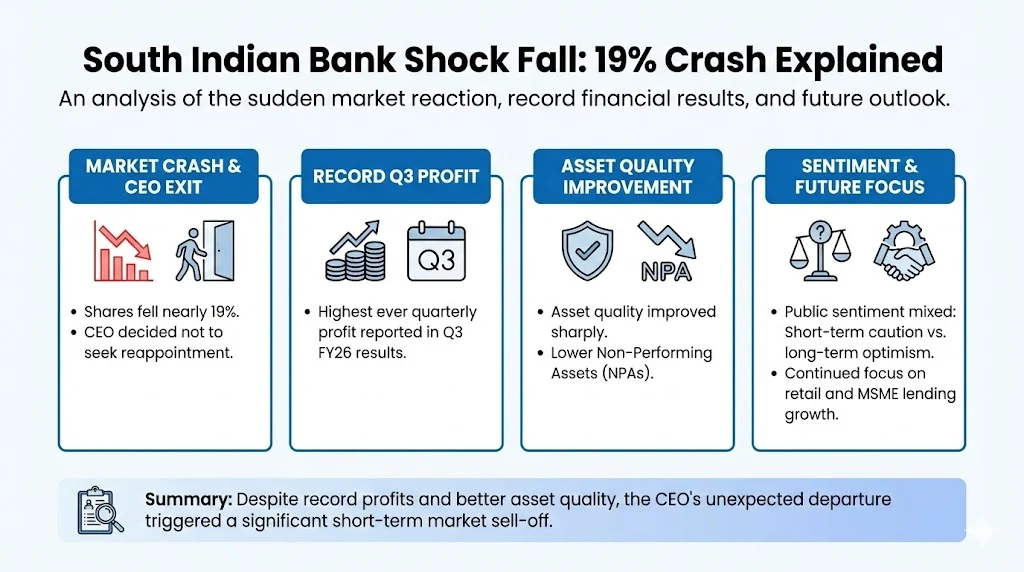

South Indian Bank Shock Fall: 19% Crash Explained

South Indian Bank Shock Fall: 19% Crash Explained | Image With Money Control

South Indian Bank has remained in focus in the stock market after a sharp fall in its share price on January 30, 2026. The bank reported strong quarterly results and showed steady recovery in asset quality. Still, investors reacted negatively after news of a leadership change became public.

The situation reflects a contrast between strong financial performance and short term market fear. While the bank’s numbers show improvement in profits and loan quality, uncertainty around the future leadership created panic selling among traders and retail investors.

Key Takeaways

- South Indian Bank shares fell nearly 19 percent after the CEO decided not to seek reappointment.

- Q3 FY26 results showed the highest ever quarterly profit of the bank.

- Asset quality improved sharply with lower NPAs.

- Public sentiment is mixed between long term optimism and short term caution.

- The bank continues to focus on retail and MSME lending growth.

Market Reaction on January 30, 2026

On January 30, South Indian Bank shares opened with a sharp gap down and remained under pressure throughout the trading session. The stock touched an intraday low near Rs 36 to Rs 37, which marked a three month low level.

The fall was one of the steepest single day declines in the bank’s history. Trading volumes were high as many investors exited their positions due to uncertainty. The decline came despite the bank reporting stable quarterly results just a day earlier.

The market reaction shows how sensitive banking stocks are to leadership news. Investors usually look for stability in top management, especially when a bank is in a recovery phase.

Reason Behind the Sharp Fall

The main reason for the fall was the announcement that Managing Director and CEO P R Seshadri will not seek reappointment after his current term ends on September 30, 2026. The bank clarified that this decision was taken due to his personal interests.

The board has decided to begin the process of identifying a successor. The appointment will require approval from the Reserve Bank of India and shareholders. Until then, the current CEO will continue in office.

Even though this was described as a planned transition, the market reacted with fear. Investors worried about continuity in strategy and execution. Leadership change in a turnaround phase is often seen as a risk factor.

Financial Performance in Q3 FY26

South Indian Bank delivered its strongest quarterly performance in Q3 FY26. The bank reported the highest ever quarterly net profit in its history. Asset quality also improved significantly compared to last year.

The following table shows key financial numbers from Q3 FY26.

| Metric | Q3 FY26 | Previous Year |

|---|---|---|

| Net Profit | Rs 374.32 crore | Rs 342 crore |

| Gross NPA | 2.67 percent | 4.30 percent |

| Net NPA | 0.45 percent | 1.25 percent |

| Advances Growth | Around 11 percent | Lower growth |

| Retail Deposits Growth | Around 13 percent | Moderate |

| CASA Ratio | Improved | Lower |

Operating profit rose by nearly 10 percent year on year. Non interest income also increased strongly. These numbers indicate that the bank’s core business is stabilizing.

The bank has shifted its focus towards retail and MSME lending. Management plans to increase this segment’s share to about 65 to 70 percent over the coming years. This strategy aims to reduce risk from large corporate loans and improve profitability.

Public Opinion from Twitter and Market Discussions

Public sentiment on social media shows both confidence and concern. Many investors praised the bank for its turnaround story and clean balance sheet. Others focused on the sudden drop and questioned whether to buy or wait.

Here is a single listicle summarizing public opinion themes:

- Investors calling the stock undervalued due to low P/E ratio around 7 and improving return on equity.

- Strong appreciation for falling NPAs and steady profit growth.

- Shock and disappointment over the CEO exit announcement.

- Debate among retail investors about buying the dip or waiting for more clarity.

- Some criticism of old digital banking systems and service quality.

Overall, there is no major negative sentiment about the bank’s business. The concern is mainly about leadership transition and short term uncertainty.

Stock Performance and Valuation

In 2025, South Indian Bank shares gained around 53 percent after hitting a low earlier in the year. Over a longer period, some return measures showed strong compound growth.

Before the fall, the stock was trading at low valuation levels compared to peers. The P/E ratio was near 7 and the price to book ratio was close to 1. These numbers attracted value investors who look for turnaround stories.

After the crash, the valuation became even more attractive on paper. However, market participants are now waiting for clarity on the next CEO and future strategy.

The sudden decline shows how news driven trading can overpower fundamentals in the short term.

Technical View and Volatility

From a technical point of view, the stock has fallen below its short term moving averages such as 5 day and 20 day averages. This indicates short term weakness and negative momentum.

At the same time, it remains above long term moving averages like 100 day and 200 day averages. This suggests that the long term structure is still not broken.

The stock also shows high beta compared to the broader market. This means it reacts more sharply to both positive and negative news. Intraday volatility crossed 30 percent, showing panic selling and fast price swings.

Such volatility is common in banking stocks when leadership or regulatory related news appears.

What the Leadership Transition Means for the Bank

The outgoing CEO played a key role in the bank’s recovery phase. Under his leadership, the bank cleaned up its balance sheet and improved profitability.

A new CEO will now take charge of maintaining this momentum. The board has stated that the transition is planned and continuity will be ensured. However, investors usually wait to see the background and vision of the new leader.

The next few months will be important for building confidence. Clear communication from the bank and timely appointment of a successor will help reduce uncertainty.

If the new leadership continues the retail and MSME focused strategy, the long term outlook may remain stable.

Customer Experience and Digital Banking

Some older feedback about the bank pointed to slow apps and outdated net banking systems. In recent years, the bank has started digital upgrades to improve customer experience.

The bank is investing in cost efficiency and technology improvements. This is important to compete with other private sector banks that already offer smooth digital services.

Better customer experience can support deposit growth and long term loyalty. This area will remain important for future growth.

Outlook for Investors

In the short term, the stock may remain volatile due to uncertainty around leadership. Traders are likely to watch price levels and news closely.

In the medium to long term, the bank’s financial numbers show improvement. Lower NPAs, rising profits, and focus on safer lending segments are positive signs.

The key risk factor is execution during the leadership transition. Stability and clarity will decide how fast investor confidence returns.

The current phase reflects a clash between strong fundamentals and emotional market reaction.

Conclusion On South Indian Bank Share Fall

South Indian Bank’s sharp fall on January 30, 2026, was driven mainly by the announcement of the CEO stepping down after his term. This news overshadowed strong Q3 results and improvements in asset quality.

Financially, the bank appears stronger than it was in previous years. Profits are rising, NPAs are falling, and lending strategy is shifting towards retail and MSME segments.

Public opinion remains divided between optimism about the turnaround and caution about leadership change. The coming months will be important in shaping the stock’s direction.

For now, South Indian Bank stands at a point where stability and communication will determine whether the recent fall becomes a temporary correction or a longer period of uncertainty.

Tags: South Indian Bank, banking stocks, Indian stock market, private sector banks, Q3 results, stock market news

Share This Post