The 6 Percent Risk Rule That Traders Ignore: Protect Your Account Before It’s Too Late

The 6 Percent Risk Rule That Traders Ignore: Protect Your Account Before It’s Too Late

Risk management sits at the core of long term trading success. Many traders focus only on finding the right setup or strategy, but real consistency comes from protecting capital.

One principle that has guided disciplined traders for years is the 6 Percent Risk Rule. This concept became popular through Dr. Alexander Elder, a trader and psychologist known for his work on trading behavior and discipline.

Key Takeaways On 6 Percent Risk Rule

- The 6 Percent Risk Rule limits total monthly risk in a trading account.

- When total realized losses plus open risk reach 6 percent, traders pause new entries.

- The rule works together with the 2 Percent Rule which limits risk per trade.

- It helps control emotions during losing streaks.

- The goal is capital preservation during difficult trading periods.

The 6 Percent Risk Rule is designed to protect traders during bad periods in the market. When performance declines, emotions can rise and traders may start taking larger risks to recover faster. This rule puts a firm cap on total exposure so that losses stay controlled and the account stays protected.

Table of Contents

Also Read: The Magic Formula by Joel Greenblatt: A Simple Way To Find Quality Stocks At Fair Prices

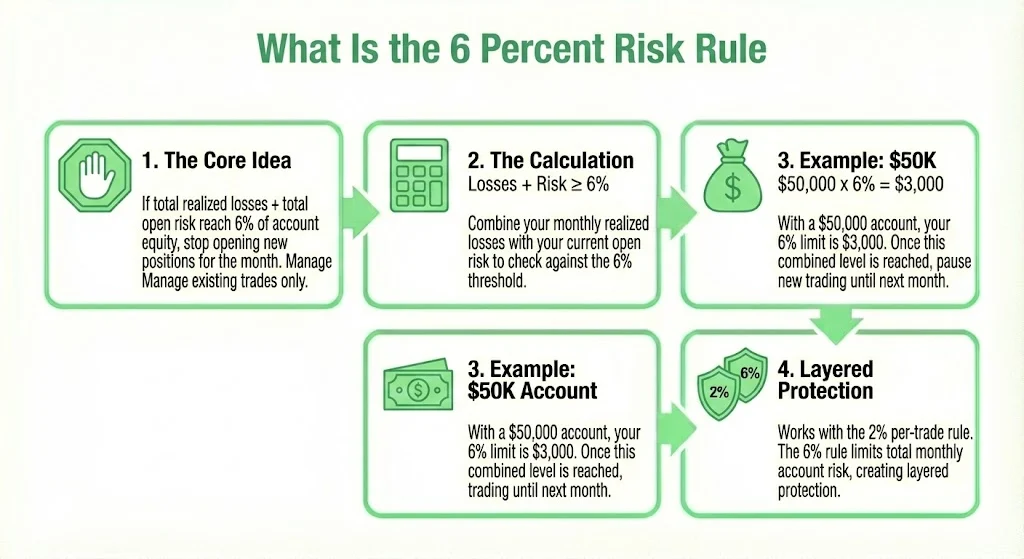

What Is the 6 Percent Risk Rule

The core idea is simple. If your total realized losses for the month plus your total open risk reaches 6 percent of your account equity, you stop opening new positions for the rest of the month. You continue to manage existing trades, but you avoid adding more exposure.

For example, if you trade with a $50,000 account, your 6 percent threshold is $3,000. Once your combined monthly losses and current open risk reach $3,000, you pause trading until the next month starts.

This rule sits beside the more familiar 2 Percent Rule. The 2 Percent Rule limits risk on any single position to 2 percent of account equity. The 6 Percent Rule then limits total account risk during the month. Together they create layered protection.

Why Traders Use This Rule

Trading results do not move in a straight line. Even strong strategies go through losing streaks. During these phases traders often feel pressure, frustration, and self doubt. Some increase position sizes. Others take more trades than normal.

The 6 Percent Rule acts as a protective circuit breaker. Once losses reach a defined level, trading stops. This prevents emotional trading, panic reactions, revenge trades, and deep account drawdowns.

It also supports psychological reset. When a trader pauses new positions for the rest of the month, they get time to evaluate, review mistakes, and reduce stress. This improves long term survival.

How The Rule Works In Practice

Traders track two elements together:

- Realized losses in the current month

- Potential open risk in active positions

If the combined amount reaches 6 percent of equity, trading pauses.

This means a trader can still hold multiple positions, but total risk across all of them must stay within limits. If exposure grows too large, they adjust stop losses or close trades to reduce risk.

Example Of Monthly Risk Control

Here is a simple example using list format:

- Account size: $50,000

- Total allowed risk for the month: $3,000

- Current realized losses: $1,800

- Current open risk across trades: $1,400

- Total current exposure: $3,200

In this case the trader has crossed the 6 percent threshold. They stop opening new trades until the next month begins.

This approach imposes discipline without limiting the number of open positions, as long as total risk remains below the cap.

How Traders View Risk Today

Recent conversations among traders continue to show strong respect for risk management. Many traders stress the importance of risking only 1 to 2 percent per trade. One trader shared that risking 5 to 10 percent per position in the past led to heavy damage. Another trader highlighted that maturity in trading means accepting losing streaks as normal and preparing for them through strict risk control.

There is some debate within the community. A few traders argue that very small risk, such as 0.25 percent, slows account growth and may not be necessary for experienced traders. Others defend small risk as a way to protect mental stability.

There is also confusion around the number 6 percent. Some discussions relate it to return expectations or market forecasts rather than risk rules. For example, some analysts warn retail investors not to assume stable 6 percent annual returns in passive investing. Others celebrate consistent 6 percent monthly returns. These conversations use the same number but carry different meanings.

Despite this mix, one theme remains clear. Traders widely value capital preservation and long term account survival. The spirit of Elder’s rule remains relevant even if the exact term is not always used.

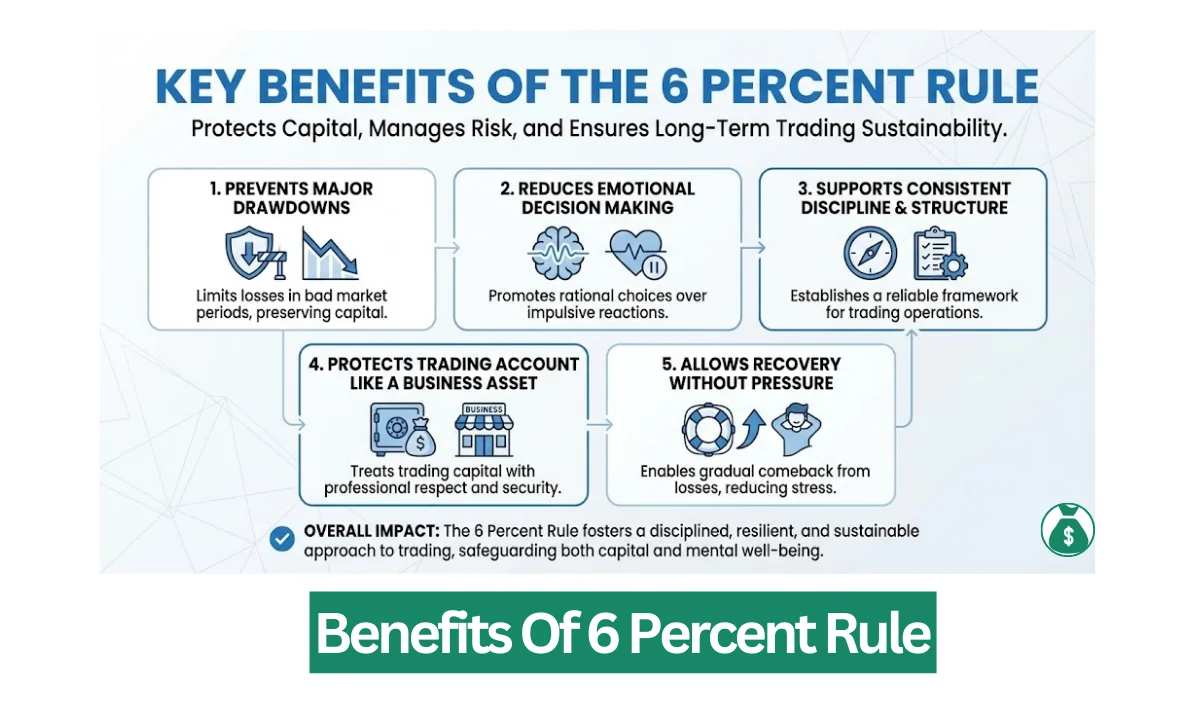

Key Benefits Of The 6 Percent Rule

The rule delivers several important benefits:

- It prevents major drawdowns in bad market periods.

- It reduces emotional decision making.

- It supports consistent discipline and trading structure.

- It protects the trading account like a business asset.

- It allows traders to recover without pressure.

When traders remove the fear of ruin, they think more clearly. Trading becomes process driven instead of emotional.

How To Calculate Your 6 Percent Level

A simple method is:

- Take your account balance at the start of the month.

- Multiply it by 0.06.

- Track your realized monthly losses.

- Track your open risk across positions.

- Add the two numbers.

- Pause new trades if the total reaches your 6 percent cap.

Many traders update these numbers weekly or daily depending on their style.

Why This Rule Supports Psychology

Losses trigger emotional responses. These responses often lead to poor decisions. The 6 Percent Rule acts as a boundary. It replaces impulse with structure.

Instead of asking “should I keep trading,” the trader already has an answer. The rule decides for them. This reduces stress and supports discipline.

Is The Rule Too Strict

Some traders feel the rule is conservative. Others see it as essential protection. The right answer depends on personal style, account size, and risk tolerance. What does remain universal is the principle behind it. Survival always comes first.

Professional traders know that risk destroys accounts faster than strategy improves them. This rule sets a guardrail around the trading process.

What Traders Are Thinking On 6 Percent Risk Rule on X?

Public opinion on The 6 Percent Risk Rule is divided but trending toward cautious support among traders. Many users say the rule helps protect accounts during bad months by limiting total risk to no more than 6 percent.

They believe this cap forces discipline, prevents revenge trading, and builds long-term survival habits. Some traders share stories of stopping early once losses reach their limit. They say this pause helps reset emotions before damage becomes permanent.

At the same time, critics argue that strict caps slow growth. They believe small accounts need higher risk to scale faster. A few prop traders suggest using the rule only during drawdowns, not during strong winning periods.

Recent posts often repeat the same message. Protect capital first. Accept that some months will be red. Focus on consistency. Public sentiment shows strong respect for traders who pause trading once the 6 percent line is hit. Many see this as a sign of maturity rather than fear.

Final Thoughts

The 6 Percent Risk Rule remains one of the strongest frameworks for disciplined trading. It combines structured money management with psychological protection. Even though online trading conversations today often focus more on the 1 to 2 percent per trade rule, the monthly cap still carries strong value for those who want to protect their account over the long run.

Risk control is the foundation of consistent trading. When traders protect capital first, they give themselves time to develop skill, test strategies, and grow experience without fearing total loss. The 6 Percent Rule helps make that possible.

Also Read: Must Know Trading and Investment Rules for Future Millionaires in India

Tags: risk management, trading psychology, forex trading, stock market strategy, capital preservation, portfolio risk control

Share This Post