The Magic Formula by Joel Greenblatt: A Simple Way To Find Quality Stocks At Fair Prices

The Magic Formula by Joel Greenblatt: A Simple Way To Find Quality Stocks At Fair Prices | Image With CNBC

The Magic Formula is one of the most well known value investing systems in modern markets. It was introduced by Joel Greenblatt in his book The Little Book That Beats The Market and later updated in The Little Book That Still Beats The Market.

The strategy ranks companies by two factors. First, how profitable the business is. Second, how cheap the stock looks compared to those profits. This helps investors buy strong companies at reasonable prices rather than chasing hype.

Key Takeaways On Magic Formula

- The Magic Formula ranks stocks by earnings yield and return on capital

- It focuses on buying quality companies at fair valuations

- It performs best during value investing cycles and corrections

- Long term discipline is important for results

- Recent returns are moderate but still competitive over full cycles

The method has gained global respect because it removes emotion. It gives investors a rules based system that does not depend on predictions.

It is simple to understand and easy to repeat. Over long periods, the idea of buying high return businesses at discounted prices has shown strength, even when short term results vary.

Table of Contents

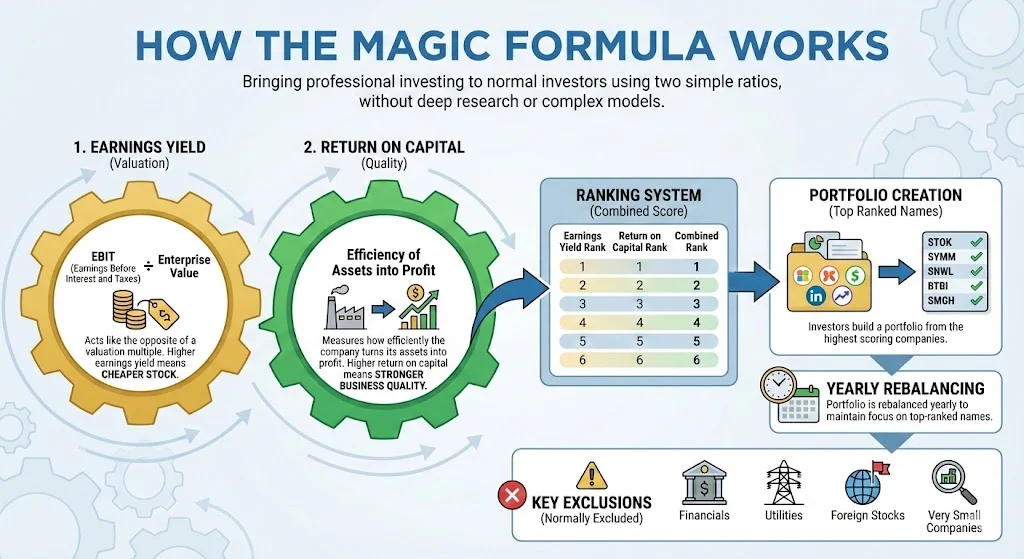

How The Magic Formula Works

Joel Greenblatt designed the Magic Formula to bring professional style investing to normal investors. Instead of deep research reports or complex models, the strategy uses only two financial ratios.

The first is earnings yield. This is earnings before interest and taxes divided by enterprise value. It acts like the opposite of a valuation multiple. Higher earnings yield means cheaper stock.

The second is return on capital. This measures how efficiently the company turns its assets into profit. Higher return on capital means stronger business quality.

Stocks are ranked on both factors. The highest scoring companies form the final list. Investors then build a portfolio from the top ranked names and rebalance yearly. Financials, utilities, foreign stocks, and very small companies are normally excluded.

Also Read: The 80/20 Rule Or Pareto Principle Rule Explained: Small Effort Big Results

Why Investors Respect The Strategy

Greenblatt is widely admired on Wall Street. His hedge fund Gotham Capital delivered strong long term returns before he wrote the book. Many investors see the formula as a blend of Benjamin Graham value discipline and Warren Buffett quality focus. It aims to buy good businesses at fair prices instead of cheap but weak companies.

The strategy has also built trust because it is simple. There is no forecasting. There is less emotion. Rules guide the buying and selling process. This reduces stress for investors who want structure.

What Performance Looks Like

Historical testing from 1988 to 2004 showed very strong returns. Some early periods saw gains of 20 to 30 percent per year. After 2005, results moderated. Growth and technology stocks began to dominate, which sometimes pushed value strategies behind the market.

However, many long term backtests still show outperformance across full cycles. For example, between 2003 and 2015, some studies found Magic Formula portfolios returning around 11.4 percent per year compared to 8.7 percent for the S&P 500.

Modified versions that add quality or reduce volatility have shown returns near 14 to 15 percent since the late 1990s in certain tests. Strict screens still highlight undervalued companies with high returns on invested capital.

The strategy tends to lag during strong growth market rallies. It often performs better during value rotations or corrections when fundamentals matter more.

Current Trends And Market Interest

In 2025 and 2026, many investors continue to use Magic Formula screens. Recent lists include stocks such as MOH, CROX, HRMY, ANF, CPRX, and YELP. These names often come from healthcare, retail, and consumer sectors. They show strong returns on capital and attractive earnings yields.

International investors also adapt the formula. Swedish portfolios include companies like Betsson, Evolution, and Autoliv. Indonesian investors also discuss the method in positive terms, highlighting its safe and systematic nature.

Online discussions show strong respect. Many users run real money portfolios using the system. Others recommend the book as essential reading. The common theme is patience and long term focus.

One Simple List Of How Investors Apply The Magic Formula

- Screen companies using earnings yield and return on capital

- Remove financials, utilities, and very small firms

- Rank companies and select top names

- Build a portfolio of 20 to 30 stocks

- Rebalance once per year

- Hold for at least three to five years

This process keeps the method disciplined. It avoids constant trading and emotional reactions.

Important Notes For Investors

The Magic Formula is not a quick win strategy. It requires patience. Some years will underperform the market. Value stocks often lag during strong momentum phases when investors chase growth names.

Investors also need to screen out low quality companies with weak governance. Corporate fraud risk or accounting issues can create value traps. Many professionals add filters like debt ratios and business durability.

The strategy works best when the investor stays consistent. Selling early or changing rules weakens results.

Public Sentiment And Ongoing Appeal On X

Public opinion remains positive. Many investors describe the formula as boring but effective. It fits people who want a structured approach. It is often listed alongside classic investing books by Buffett and Lynch.

Tweets show admiration for Greenblatt’s earlier fund performance above 40 percent in some years. Users like that the strategy rewards discipline rather than speculation. They also appreciate that it supports long term compounding.

There is also growing interest from younger investors. Some treat the system as a starting screen rather than a final decision tool. They add extra filters for risk, quality, and industry conditions.

Why The Magic Formula Still Matters Today

Markets change, but valuation and profitability always remain important. The Magic Formula highlights companies that combine both strengths. This aligns with core principles of value investing.

Even though returns today are lower than early claims, many investors still see the method as a reliable framework. It helps people avoid hype cycles and emotional mistakes. It supports rational thinking, consistent analysis, and patience.

The formula will not beat the market every year. But over time, the idea of buying strong companies at fair prices continues to hold weight across global markets and economic cycles.

Final Thoughts

The Magic Formula by Joel Greenblatt remains one of the clearest examples of disciplined value investing. It keeps investing simple. It removes emotional bias. It blends quality and price in a measurable way.

Recent performance is more modest than historic highs, but the system still shows strength across full market cycles. It also adapts well through filters and variations. This is why investors worldwide continue to follow and discuss it.

For anyone seeking a structured path into value investing, the Magic Formula still stands as a respected reference point.

If are looking to know more about such rules you can visit:

Must Know Trading and Investment Rules for Future Millionaires in India

Tags: magic formula investing, joel greenblatt, value investing, stock market strategy, earnings yield, return on capital

Share This Post