Yes Bank Share Price Today Stays Range Bound Near ₹22 As Q3 Results Draw Mixed Views

Yes Bank Share Price Today Stays Range Bound Near ₹22 As Q3 Results Draw Mixed Views

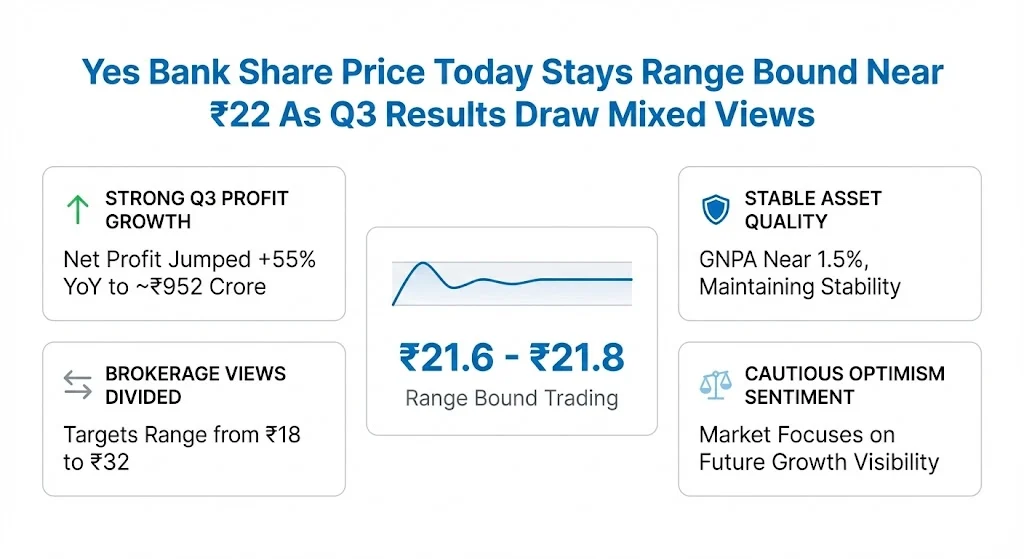

Yes Bank share price is trading in a narrow range near ₹21.6 to ₹21.8 in late January 2026. The stock has shown small intraday movements in recent sessions, reflecting a pause after the sharp recovery seen over the past year. On January 21, 2026, the share closed around ₹21.66, moving within a daily band of roughly ₹21.5 to ₹22.0.

The current phase indicates consolidation rather than momentum driven buying or selling. Investors are tracking quarterly performance, broker commentary, and signs of sustained growth as the bank continues its transition into a more stable private sector lender after years of stress.

Table of Contents

Key takeaways

- Yes Bank share price is trading near ₹21.6 to ₹21.8 with limited short term movement

- Q3 FY26 net profit jumped 55 percent year on year to about ₹952 crore

- Asset quality remains stable with GNPA near 1.5 percent

- Brokerages are divided with targets ranging from ₹18 to ₹32

- Market sentiment shows cautious optimism with focus on growth visibility

Also Read: EPFO 3.0: What Is Changing in PF Services And Why It Matters for Members

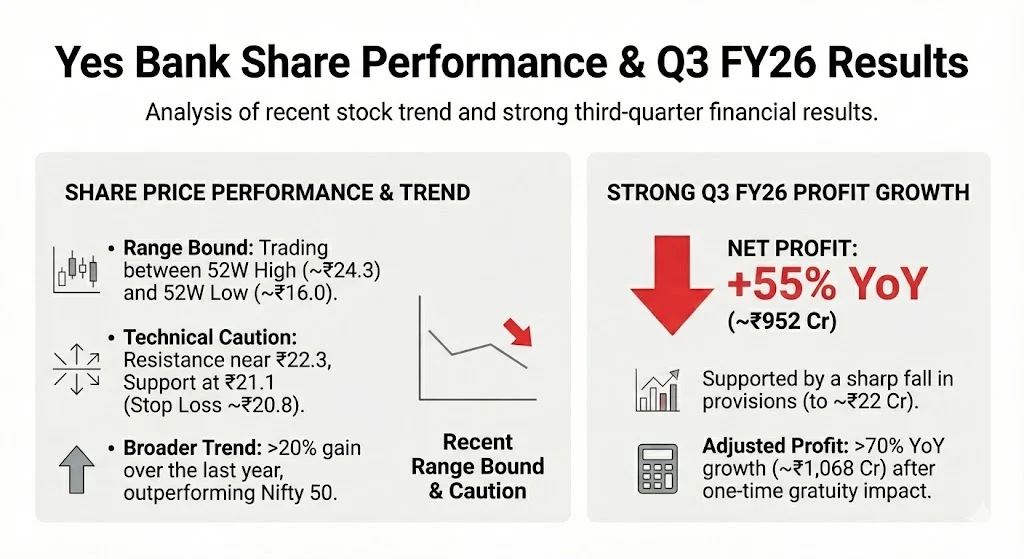

Yes Bank Share Price Performance & Recent Trend

The share price of Yes Bank Ltd has remained largely range bound in recent weeks. The stock is currently trading below its 52 week high of around ₹24.3 and well above the 52 week low near ₹16.0. This movement suggests that the market is digesting recent earnings without taking aggressive directional bets.

Technical indicators point to short term caution. The stock has struggled to sustain above key moving averages, and analysts note resistance near the ₹22.3 level. Support is seen around ₹21.1, with a stricter stop loss level highlighted near ₹20.8 for long term holders.

Despite this, the broader trend over the last one year remains positive, with the stock gaining over 20 percent and outperforming the Nifty 50 during the same period.

Q3 FY26 results show strong profit growth

Yes Bank reported a strong set of numbers for the December 2025 quarter. Net profit rose 55 percent year on year to approximately ₹952 crore. The growth was supported by a sharp fall in provisions and stable operating performance.

Provision costs dropped sharply to about ₹22 crore, compared with ₹419 crore in the previous quarter and ₹259 crore in the same quarter last year. This decline played a major role in lifting reported profitability for the quarter.

After adjusting for a one time gratuity impact linked to labour code changes, profit was higher at around ₹1,068 crore, showing growth of more than 70 percent on a year on year basis.

Asset quality and margins continue to improve

Asset quality remained steady during the quarter. Gross non performing assets stayed close to 1.5 percent, reflecting controlled slippages and effective recovery efforts. Credit costs were negligible, supporting the bottom line.

Net interest margin improved to about 2.6 percent, rising both year on year and quarter on quarter. Lower deposit costs and repricing of assets contributed to this expansion. Net interest income grew around 11 percent compared to last year.

Return on assets moved closer to the 1 percent mark, reaching around 0.9 percent for the quarter. Return on equity also improved but remains lower than private sector peers, which continues to be a key concern for analysts.

Operating efficiency shows gradual progress

Non interest income rose about 8 percent year on year to nearly ₹1,633 crore. Fee income from credit cards, insurance distribution, and third party products supported this growth. Retail focused fee streams showed gradual improvement.

Operating expenses increased around 7.8 percent year on year to ₹2,865 crore. After adjusting for the gratuity impact, expense growth was much lower. This helped improve the cost to income ratio to around 66 percent from over 71 percent last year.

The bank continues to focus on cost control and operational efficiency as part of its normalization journey.

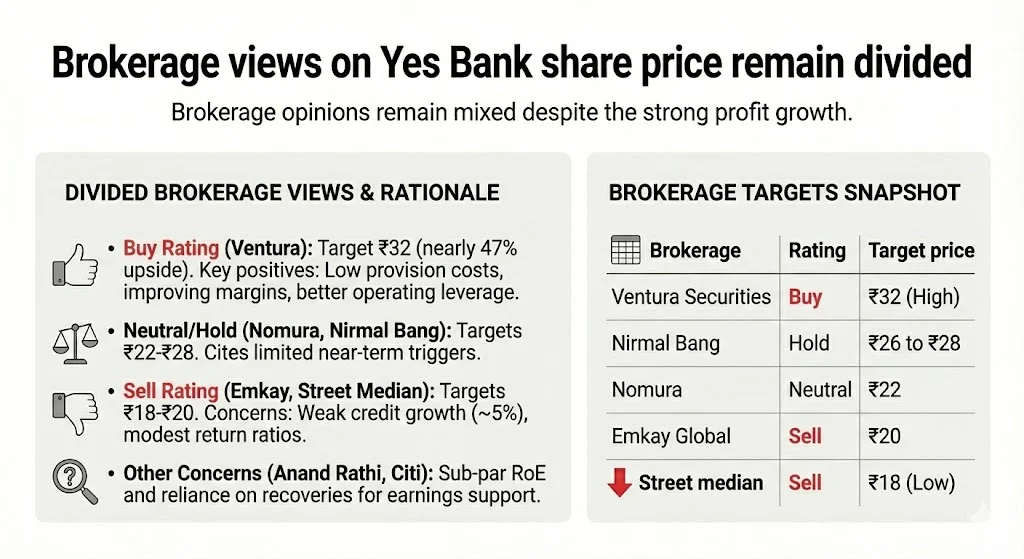

Brokerage views on Yes Bank share price remain divided

Brokerage opinions on Yes Bank remain mixed despite the strong profit growth. Some firms see meaningful upside, while others remain cautious on growth sustainability and valuation comfort.

Ventura Securities retained a Buy rating with a price target of ₹32. This implies nearly 47 percent upside from current levels. The brokerage highlighted low provision costs, improving margins, and better operating leverage as key positives. The stock is valued at around 1.7 times FY28 estimated adjusted book value under this view.

Other brokerages remain more conservative. Nomura has a Neutral rating with a target of ₹22, citing limited near term triggers. Emkay Global maintained a Sell rating with a target of ₹20, pointing to weak credit growth of around 5 percent and modest return ratios.

Anand Rathi and Citi have also flagged concerns around sub par return on equity and reliance on recoveries rather than core growth to support earnings.

Brokerage targets snapshot

| Brokerage | Rating | Target price |

|---|---|---|

| Ventura Securities | Buy | ₹32 |

| Nirmal Bang | Hold | ₹26 to ₹28 |

| Nomura | Neutral | ₹22 |

| Emkay Global | Sell | ₹20 |

| Street median | Sell | ₹18 |

Market sentiment from X reflects cautious optimism

Recent discussions on X show a balanced tone among investors. Positive posts focus on the sharp profit jump, stable asset quality, and return on assets nearing 1 percent. Some users describe the bank as being in recovery mode, supported by institutional confidence and declining retail shareholding.

There is also appreciation for management continuity, including regulatory approvals for senior leadership roles. Strategic partnerships and institutional backing are seen as supportive factors for long term stability.

At the same time, caution remains visible. Many posts highlight that the stock is likely to remain range bound in the short term. Concerns around modest loan growth, capital infusion timelines, and valuation limits are frequently mentioned. A few customer level complaints exist but do not dominate investor discussions.

Overall sentiment positions Yes Bank as a steady turnaround story rather than a high momentum trade.

Key risks to monitor going forward

While progress is visible, several risks remain on the radar. Loan growth needs to accelerate beyond the mid single digit range to support sustainable earnings expansion. Retail and SME segments remain areas to watch closely.

Return ratios still lag private sector peers, and further improvement is required to justify higher valuations. Any unexpected rise in credit costs or fresh asset quality stress could impact sentiment quickly.

External factors such as interest rate movements, economic growth, and pending legal matters related to legacy instruments also remain relevant for the stock.

Outlook for Yes Bank share price

Yes Bank share price currently reflects a balance between improved fundamentals and lingering concerns. The stock is trading near fair value based on average analyst estimates, with upside dependent on continued execution and visible growth.

For long term investors, the story is now about consistency rather than recovery alone. Stable margins, controlled asset quality, and stronger loan growth could gradually improve confidence. In the near term, the stock is expected to remain within a defined range as the market looks for clearer signals

Also Read: Silver ETF Momentum Holds Attention After Historic Rally and Sharp Corrections

Tags: Yes Bank, Yes Bank share price, Indian banking stocks, Q3 results FY26, private sector banks, stock market news

Share This Post